Sometimes this supplier news cycle feels like this Ferris wheel, it keeps going around and around, but nothing is moving forward. And that is to be expected during a holiday week, but there were a few interesting gems that stood out.

Dell continues to have issue with the EMC acquisition. VMWare stockholders are not pleased with the financial engineering happening to make Virtuastream a reality… and they are starting to make demands.

HPI is having some growing pains in the printer market while sister company HPE is doing… ok (they found a new dance partner at Microsoft).

Big Blue had 17% growth in the security products market this year and Ginni is letting customers know what a grave threat hackers are.

IBM

- IBM’s CEO On Hackers: ‘Cyber Crime Is The Greatest Threat To Every Company In The World’

We believe that data is the phenomenon of our time. It is the world’s new natural resource. It is the new basis of competitive advantage, and it is transforming every profession and industry. If all of this is true – even inevitable – then cyber crime, by definition, is the greatest threat to every profession, every industry, every company in the world.”

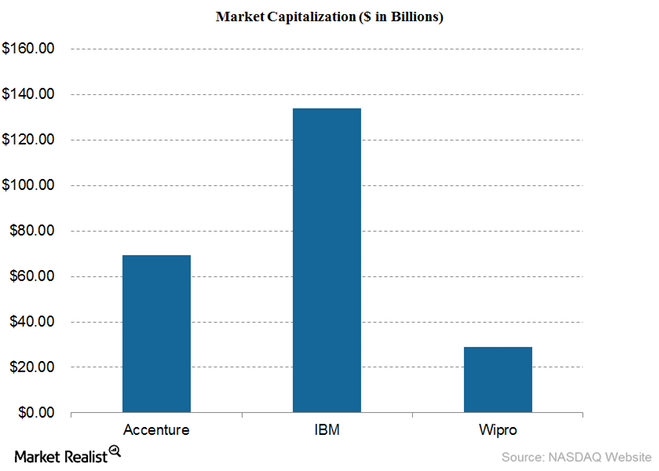

- IBM: A Heavyweight in the IT Consulting Space

IBM (IBM) is a global leader in the IT consulting space. It was founded in 1911 and is headquartered in New York. In 2012, Fortune ranked IBM as the second largest firm by number of employees and the fourth largest in terms of market cap. It was also rated the ninth most profitable firm and the 19th largest firm in terms of revenues. In the last few years, IBM shifted its focus on high-profit segments such a data analytics, business intelligence, cloud computing, and green solutions. It currently has a market cap of $133.8 billion.

http://marketrealist.com/2015/11/ibm-heavyweight-consulting-space/ - Why IBM spent billions buying technology it already had access to

“A couple of clients talked to IBM about weather data. If you think of the insurance industry as one example, one client told us that a single hail storm in the middle of Phoenix one year, and a hail storm that lasted only a few hours, caused more than $20 million in damages,” Suh said.

- IBM’s Watson Won’t Be Predicting Eruptions Anytime Soon

Unlike the weather analogy given in some of the articles reporting on IBM’s plans, geologic prediction isn’t going to be as easy as reading a bunch of sensors, because those sensors need to capture events going on deep underground. We might be able to add a pile of sensors at the surface, but in order to really understand (and then predict) the behavior of magmatic systems, those sensors will need to be put closer to the magma itself as it percolates kilometers underground. Throwing up a weather station, this is not.

http://www.wired.com/2015/11/ibms-watson-wont-be-predicting-eruptions-anytime-soon/

Hewlett Packard Enterprises

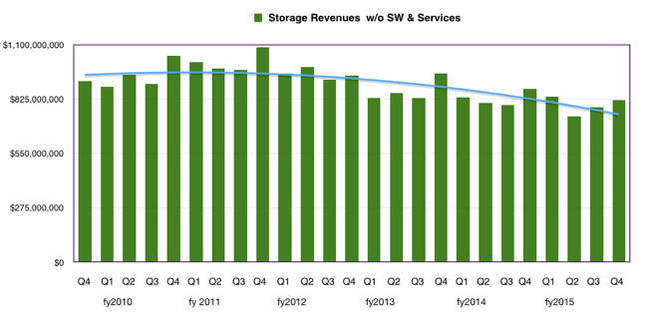

- HPE storage financials: Meh. Meg Whitman needs to make this right

Within HP’s* revenues for the fourth fiscal 2015 quarter, converged storage product revenues (3PAR, StoreOnce, and StoreAll) grew nine per cent while the traditional ones (EVA, MSA, & Tape) declined 19 per cent compared to the year-ago quarter.

http://www.theregister.co.uk/2015/11/26/hp_results_q4_fy2015/ - HP Enterprise will maximize opportunities as Azure reseller

This certainly makes sense considering they gave up on their own cloud platform…As announced in the company’s quarterly earning call, the plan is to have Microsoft and HPE be “preferred” customers of each other’s products. HPE will likely sell server hardware to serve as on-premises nodes in the hybrid fabric that Microsoft has in mind for Azure.

HP Inc

- Lackluster Results Fueled Concerns Regarding Its Ability To Weather A Slowdown In The Printer And PC Markets

Dion Weisler, Chief Executive of HP stated that the printing business is much greater challenge than the PC business. The firm has been lowering printer prices to tackle stiff rivalry, particularly from Japanese printer makers Epson and Canon. However, the price reductions, coupled with the effect of a stronger dollar, have reduced the value of income from foreign markets. Weisler stated that the unintended result is that they are not getting the yield per unit they would have expected. HP revealed that revenue from printer supplies such as laser toner and ink cartridges fell 10% in the period. Supplies account for most of the profits for HP Inc.

- HP Inc reaches new low as shares slump

“We do not expect the landscape to improve in the near future and we will constantly assess how the market evolves,” he said. “In any case our market leadership and scale serve us well, but we have much more work to do on many dimensions.”

http://www.channelweb.co.uk/crn-uk/news/2436670/hp-inc-reaches-new-low-as-shares-slump

EMC

- Repercussions of the DELL-EMC Deal

Investors are demanding:EMC and VMware should withdraw the joint venture of Virtustream, given that VMware’s price has fallen since the announcement. This is damaging the implied value of the proposed stock, which Dell will use to pay for the deal.

Lastly, institutional investors have asked for an adjustment to the tracking stock rights. Tracking stocks are an equity offering issued by the parent company (Dell) to sell the minority interest in one of its profitable divisions (VMware) to the public.

http://marketrealist.com/2015/11/repercussions-dell-emc-deal/

- EMC to take a majority stake in Virtustream – report

Earlier this week Re/code reported that VMware and EMC shareholders have asked for Virtustream to be unwound, as it has been responsible for “further dragging down VMware shares”. Now, according to the Reuters report, which cited people familiar with the matter, EMC is going to take a majority stake in Virtustream and VMware would only have a minority share. This would mean EMC would assume Virtustream’s losses, the report said.

Other

- Where Are All The Enterprise Tech Buyers?

With Dell/EMC/VMware busy in their own deal, the number of smaller enterprise tech acquisitions will shrink even further. CB Insights points out here that, “There have only been 45 $100M+ exits in the first three quarters of 2015, which puts it on track to be the first year with less than 70 $100M+ exits since 2010.”

http://techcrunch.com/2015/11/22/where-are-all-the-enterprise-tech-buyers/

Photo: Adrianna Calvo