GE is getting in on the artificial intelligence game with the acquisition of two AI firms. As the company tries to bolster their Predix cloud platform, Amazon and Google are about to officially unleash their own machine learning platforms.

As GE, Amazon, and Google grow their services, is IBM faced with the possibility of having to write off their cloud solution? It seems the company vastly overpaid for SoftLayer ($2B to buy, another $1B in enhancements) and it is bringing in a fraction of that cost.

AWS continues to quietly chalk up wins. They scored a hosting and platform provider deal with Tableau this week.

Acquisitions

- Oracle Buys Santa Monica Offices for $368 Million

Software giant Oracle Corp. has purchased a Santa Monica office building for $368 million, according to a source familiar with the deal. At roughly $1,165 a square foot, the transaction is one of the priciest ever per square foot for a large office complex in Los Angeles.

http://www.labusinessjournal.com/news/2016/nov/18/oracle-buys-santa-monica-offices-368-million/

This is the 2nd real estate transaction Oracle has been involved in over the last two months.. - Oracle acquires DNS provider Dyn, subject of a massive DDoS attack in October

Oracle plans to add Dyn’s DNS solution to its bigger cloud computing platform, which already sells/provides a variety of Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) products and competes against companies like Amazon’s AWS.

Oracle and Dyn didn’t disclose the price of the deal but we are trying to find out. Dan Primack reports that it’s north of $600 million. We’ve also asked for a comment from Oracle about Dyn’s recent breach, and whether the wheels were set in motion for this deal before or after the Mirai botnet attack in October, but our guess is that it was likely before.

- Symantec will acquire identity protection firm LifeLock in $2.3B deal

The deal will create what the two companies described as the world’s largest consumer security business with over $2.3 billion in annual revenue based on last fiscal year revenue for both companies.

The immediate opportunity for Symantec comes from the large number of consumers worldwide that have been victims of cybercrime, generating as a result greater user concern in digital safety. The companies estimate the market at $10 billion, and growing in the high single digits. In the U.S. alone, the total addressable market is estimated to be about 80 million people.

- Google acquires Qwiklabs to teach developers cloud skills

Qwiklabs, which launched in 2012, has only focused on teaching skills for Amazon’s AWS platform so far. Given AWS’ dominance in the marketplace, that made perfect sense. Amazon even uses Qwiklabs as its go-to service for offering self-paced labs for developers on its platform.

Google says it will use Qwiklabs’s platform to focus “on offering the most comprehensive, efficient, and fun way to train and onboard people across all our products on Google Cloud, including Google Cloud Platform and G Suite.”

https://techcrunch.com/2016/11/21/google-acquires-qwiklabs-to-teach-developers-cloud-skills/

- What does Trump mean for tech M and A?

On Monday, Trump announced that Mark Jamison and Jeff Eisenach were joining his “agency landing team.” These FCC appointees have both written about how they weigh antitrust issues.

They could potentially make it harder for industry leaders like Alphabet to make large strategic purchases. “Potential headwinds include issues relating to increased regulatory review on deals,” said Page.

https://techcrunch.com/2016/11/21/what-does-trump-mean-for-tech-ma/?ncid=rss

Artificial Intelligence

- GE wants to be the next AI powerhouse

Today GE revealed the purchase of two AI companies that Ruh says will get them there. Bit Stew Systems, founded in 2005, was already doing much of what Predix Cloud promises—collecting and analyzing sensor data from power utilities, oil and gas companies, aviation, and factories. (GE Ventures has funded the company.) Customers include BC Hydro, Pacific Gas & Electric, and Scottish & Southern Energy.

The second purchase, Wise.io is a less obvious purchase. Founded by astrophysics and AI experts using machine learning to study the heavens, the company reapplied the tech to streamlining a company’s customer support systems, picking up clients like Pinterest, Twilio, and TaskRabbit. GE believes the technology will transfer yet again, to managing industrial machines. “I think by the middle of next year we will have a full machine learning stack,” says Ruh.

- AWS launching cloud-based machine learning service

Colin Sebastian, an analyst for R.W. Baird, recently said he believes Google’s machine learning and AI efforts give it an edge over Microsoft Azure and Amazon Web Services in the enterprise. “Google would ultimately be able to differentiate its enterprise offering from competitors by leveraging advanced ML capabilities and monetize ML through a range of business services,” said Sebastian

http://www.ciodive.com/news/report-aws-launching-cloud-based-machine-learning-service/430808/

Cloud

- Amazon becomes one of the largest corporate backers of solar (wind, now solar)

US electronic commerce giant Amazon has become the largest corporate backer of solar east of the Mississippi River with the launch of five new solar PV projects in Virginia totalling 180MW.

Four of the projects, with a capacity of 20MW each, will be brought online before the end of next year and are located in New Kent, Buckingham, Sussex and Powhatan.

The largest project in the bundle is the 100MW facility in Southampton County, known as Amazon Solar Farm US East 6. The five new projects join Amazon’s existing 80MW facility in Accomack County which is already operational.

http://www.pv-tech.org/news/amazon-becomes-one-of-the-largest-corporate-backers-of-solar

- IBM And SoftLayer: Is A $3 Billion Write-Off Looming?

We believe a write-off of SoftLayer of similar magnitude (85%-90%) is almost certainly in the forefront of CFO Schroeter’s mind these days. To comply with Generally Accepted Accounting Principles, a sizable write-down is necessary, since SoftLayer is likely worth a tiny fraction of what IBM has invested. As we’ll explain in a bit, SoftLayer is niche cloud player with limited functionality and limited upside. Its infrastructure products are not competitive in mid- and enterprise-level markets.

http://seekingalpha.com/article/4025920-ibm-softlayer-3-billion-write-looming

Datacenter

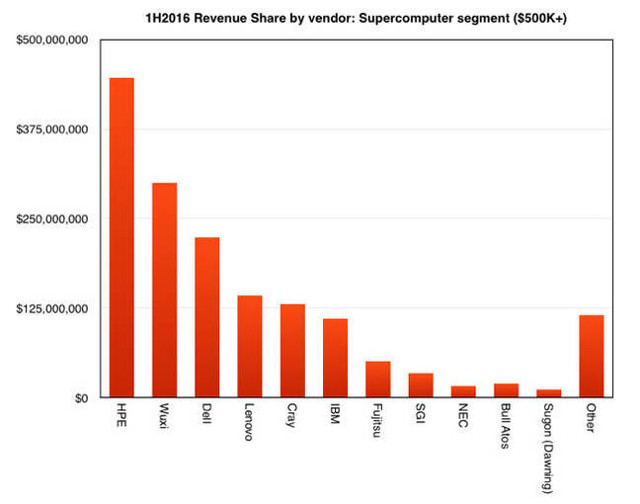

- HPE is creaming Dell in HPC

If we add SGI revenues to HPE’s we get $480,343,000, which makes HPE more than twice as big as Dell EMC in this sector.

IDC’s overall world-wide server supplier revenue market share numbers also show HPE comfortably ahead of Dell EMC. In the second 2016 quarter, HPE had a 25.4 per cent market share with $3.4bn in sales. Dell was second with $2.6bn in sales and a 19.3 per cent market share. No other supplier was in the double-figure market share percentage area.

http://www.theregister.co.uk/2016/11/18/hpe_is_creaming_dell_in_hpc/

Software/SaaS

- Red Hat CEO explains why tech giants are turning to open source

The big issue is when you want to run something in production. The example I’ll use is Linux. You’re running your SAP application on Linux and that’s great, but now there’s a bug that needs to get fixed, and the open source community fixes that on the brand new version of Linux. If you’re running on a three-year old version of Linux, nobody’s looking at that version for a bug or a security hole, but you don’t want to re-integrate and re-test your SAP system every time there’s a new version. That’s what Red Hat does.

http://fortune.com/2016/11/18/red-hat-ceo-james-whitehurst-microsoft-google-software/

- Tableau Cozies Up to Amazon Cloud

The news, to be formally announced next week at the annual AWS Re:Invent conference in Las Vegas is that Tableau Online will run on Amazon’s massive public cloud and that customers will be able to buy it through the AWS Marketplace.

Other

- Salesforce, Inc.: This Is Sending CRM Stock Soaring Today

Salesforce, the business software provider and CRM leader, posted revenue of $2.14 billion for the third quarter, beating consensus Wall Street estimates of $2.12 billion. Marc Benioff, chairman and CEO, Salesforce said, “Salesforce delivered an exceptional quarter with year-over-year revenue growth of 25% in dollars and 27% in constant currency.”

http://www.profitconfidential.com/stock/salesforce-inc-this-is-sending-crm-stock-soaring-today/

Photo: Urbex Clan