SourceCast: Episode 123: Microsoft Buys Github

SourceCast: Episode 57: Start Up, Sell Out

SourceCast: Episode 33: Showing the Value

Supplier Alert: Verizon will purchase Yahoo for $4.8B

News on the street is that Verizon may purchase Yahoo’s core internet this Tuesday.

Update: Verizon has officially announced they will purchase Yahoo for $4.83B.

Verizon already bought a company that your grandparents probably use for email… AOL. So what is appealing about Yahoo at this point for Verizon?

Reportedly, the offers that have come in have been between $3 billion and $5 billion for a range of assets that include not only the search and media businesses, but real estate and IP. Yahoo’s “Excalibur” patent portfolio contains 2,600 technical patents and Yahoo optimistically values it at upwards of $1 billion.

But after months of small movements in this saga, and years of steady decline at Yahoo, in a way, it’s not at all a surprise to hear that Verizon may end up getting Yahoo at the end of it.

Speaking of AOL, Verizon didn’t buy them for their still profitable dial-up business. So what was the appeal of AOL last year?

If Verizon intends to keep expanding, new growth won’t come from adding more customers each quarter or through acquiring a competitor. The company will have to make more money off its existing customers through alternative means, because its traditional avenues for increasing revenue—voice, messaging and data—won’t cut it. Verizon already offers unlimited voice and text plans to most of its customers, and while data usage is increasing, competition is gradually driving down the per-gigabyte prices.

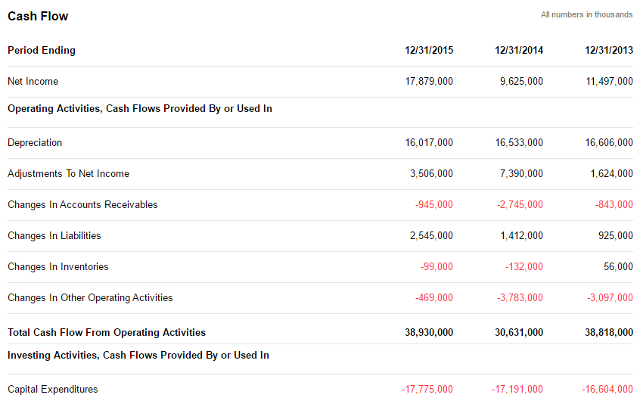

Why is owning AOL and Yahoo a viable direction for Verizon? Verizon can’t buy another telecom company and fighting the other wireless providers down to the lowest prices isn’t appealing (and they aren’t winning that game anyway). And how does their cash flow look?

The company made almost $18B last year and they have enough cash to swing a $3-5B purchase. But is it really a wise investment? Is there anything in those Yahoo patents that is such a game changer from what they already own thanks to AOL?

Verizon is following Comcast’s lead with NBC and buying companies that creates content, so they can make money off of ads however:

Of course, even with AOL and Yahoo assets, Verizon has a long way to go (paywall) to catch up with the online advertising leaders. Verizon with AOL currently holds a mere 1.8% of the $69 billion digital ad market in the US. Yahoo has about 3.4%. Google and Facebook together claim about half of it. Looked at another way, though, there’s plenty of market share to steal, which can’t be said of its traditional business.

What becomes of the rest of Yahoo? The Yahoo we know would be over and there will be a chunk left over that manages the valuable Alibaba asset moving forward. Update on what assets are not being sold:

Yahoo’s stakes in Alibaba and Yahoo Japan aren’t part of the acquisition. These stakes are worth tens of billions of dollars alone. As of Friday July 22nd, Yahoo’s 15 percent stake of Alibaba represented $31.2 billion, and its 34 percent of Yahoo Japan was worth $8.3 billion. Yahoo’s patent portfolio, which is worth around $1 billion, isn’t part of the sale either. Yahoo’s Sunnyvale headquarters are part of the acquisition, a source told TechCrunch.

Photo: Adrianna Calvo