IBM purchased another company named Gravitant this week. It helps customers select cloud services from a variety of providers (and is a cloud service itself). I know I keep saying this, but IBM is consistent with their purchases: Cloud, Analytics (Big Data), and IoT. Now I want to see all the pieces put together.

And when you have it all together, then you break it apart. HPE announced the departure of their CIO on the first official business day as Hewlett Packard Enterprises. The market seems to be down on HPE at the moment, while their sister company HP Inc gained on their opening day despite concerns about the health of the PC and printer markets.

The Dell/EMC acquisition continues to befuddle me. Rumor has it that Dell is looking to sell off $10B in assets (wise move) to pay down their massive debt. They are also looking to rush a startup that EMC and VMWare (and GE) created called Pivotal to IPO to help generate additional funds. So… Dell goes private and loves it, they are buying EMC and taking them private (presumably), but they are KEEPING VMWare public, and starting another company with the EMC asset and doing an IPO… that made my fingers hurt.

IBM

- IBM’s Shopping Spree Continues As It Buys Cloud Brokerage Firm Gravitant

With Gravitant, it gets cloud brokerage, which helps companies manage cloud purchases across multiple suppliers. IBM plans to fold the new bauble into its IBM Global Technology Services unit. In addition, IBM Cloud plans to add the capabilities to its growing SaaS catalogue.

That’s like a two for one sale because Gravitant gets sold as an old fashioned service offering, and also as a SaaS product, which plays well into IBM’s overall strategy.

- The Mainframe Is a Vampire

If you looked at the recent IBM numbers, which were pretty painful but in line with what generally happens when a company is adapting to a major industry change, you saw one bright light: their mainframe business was growing faster than the server segment in general is growing.

In fact, with the massive growth of web services, it has been hard for the server segment to get out of the low single digits. But once you adjusted for currency fluctuations, mainframes (IBM’s System Z) were up a whopping 20 percent. That’d be impressive server growth in a good year, for what has been a really soft year for servers, 20 percent growth is outstanding.

http://www.datamation.com/commentary/the-mainframe-is-a-vampire.html

- Why the IBM – Weather Company purchase is a big deal (shameless plug: I cover this topic on the SourceCast podcast episode #3, which will go live tomorrow… so visit again!)

http://www.bloomberg.com/news/videos/2015-11-05/ibm-to-buy-weather-company-why-that-s-a-big-deal - IBM Watson is going to change how you think about the weather (Here is a non-video article that says similar (internet of) things)

The focus at IBM is not so much in getting Watson involved in making better weather forecasts, but in putting the world’s most famous supercomputer to work in mining epic amounts of data in order to help businesses come up with actionable insights about the weather on both a real-time and long-term basis.

EMC/Dell

- Pivotal IPO Could Make Dell-EMC Deal Even More Complicated

As a reminder, EMC owns 80 percent of VMware, which is operated and traded as an independent company. When Dell agreed to buy EMC for $67 billion last month the deal included VMware, which Dell has said it wants to continue operating in the same fashion.

Pivotal is itself a joint venture of EMC and VMware along with GE (which owns around 10 percent). The plan could call for EMC to sell about 20 percent of its ownership stake as an IPO, which is similar to what it did when it took VMware public in 2007, according to the re/code article.

If this is true, it’s just another case of this deal getting ever more muddled with multiple layers of ownership, all pointing back to Dell, which if this closes is the ultimate decider here. Let’s not forget, however that EMC has a clause in its agreement that if it gets a better offer than the $67 billion that Dell offered it, it could take that deal.

http://techcrunch.com/2015/11/03/pivotal-ipo-could-make-dell-emc-deal-even-more-complicated/

- Dell planning to sell off $10 billion in assets (rumor)

It is too early to say I called it, but keep watching for news like this…Reuters reports the PC vendor is planning this to reduce the heavy debt load it will be taking on to buy data storage company EMC for around £44 billion. In 2007, EMC sold 19 percent of VMware shares in an IPO on the New York Stock Exchange. A successful Pivotal IPO could potentially raise billions in new capital

http://financialspots.com/2015/11/04/dell-planning-to-sell-off-10-billion-in-assets-rumour/

Here is more information on the sell off providing possible asset targets:

Unnamed sources told Reuters that Dell will take on about $49.5 billion after it completes the $67 billion acquisition of EMC and its federated companies sometime next year. Selling such assets as its Quest software business (for systems management), SonicWall (network security) and AppAssure (data backup) will help the company reduce the debt load, according to the sources.

Hewlett Packard (HPE & HPI)

Note: I suspect my coverage of HP Inc will dwindle with time, but for now, I will cover both companies.

- Hewlett Packard Enterprise Loses CIO As It Charts New Course

Ralph Loura, who had served as chief information officer of the enterprise business of HP for the past 15 months, has left the company. “I had an impact while there [and] I helped design the new op model for IT, and designed myself out of it because it was what the new company needed (move from a federated model with group CIOs, to a unified/centralized model with a single CIO),” he wrote to CRN.

- Why JPMorgan Is Cautious On HP Inc (HPQ)

The skeptical view taken by the firm comes on the back of PC data, which is hardly reassuring. Seagate and Western Digital both guided for a decline in HDD TAM for the fourth quarter. Intel reported a 19% YoY decline in its PC shipments for 3QFY15 worse than the 10% decline witnessed in 2QFY15. Desktops and Notebooks posted even worse numbers and there is scarcely anything notable that stirs confidence. While HDD companies see signs of stabilization, analysts at JPMorgan are far from convinced and expect more macro instability.

http://www.businessfinancenews.com/25953-why-jpmorgan-is-cautious-on-hp-inc-hpq/

However, On Monday, the stock market reacted like this (per USA Today):

HPQ, which sells PCs and printers, soared 13%, to $13.83; HPE, responsible for commercial computer systems, software and services, fell 1.6% $14.49. Both stocks are trading on the S&P 500.

Other

- Why Billionaire Trader Stan Druckenmiller Believes In Amazon And Not IBM

“We are in a bubble in what I would call short term behavior,” Druckenmiller said. To reinforce the point Druckenmiller gave a negative assessment of IBM, which he said has missed earnings only three times over the past nine years and is in the process of buying back billions in stock, and a bullish view on Amazon.com… the difference? While IBM is cutting R&D spending against a shrinking base of sales, Amazon has doubled that spending as a percentage of sales even as they’ve grown at double digit rates. “I love Amazon. They are investing on the future,” Druckenmiller said, before quipping, “Bezos is a serial monopolist.”

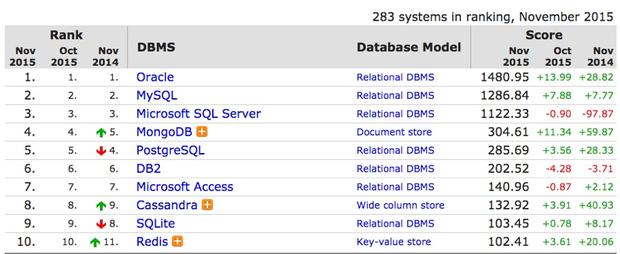

- Will NoSQL be the undoing of Oracle’s database reign?

What’s most interesting in all this is how database popularity, broadly measured, compares with Gartner’s newly released Operational Database Magic Quadrant. TechRepublic contributor Janakiram MSV has captured five big takeaways from Gartner’s report, but here’s a sixth:The database vendors that embrace NoSQL are destined to be the long-term winners.

Photo: DB-Engines http://www.techrepublic.com/article/will-nosql-be-the-undoing-of-oracles-database-reign/

- Why Did Microsoft Corporation Paint Its Cloud Red?

As part of the deal, Microsoft will feature Red Hat’s Linux as a “preferred” option for enterprise computing jobs on Azure. The deal comes in as a surprise for many as the companies have historically had differing stances on software patents and usage. Red Hat has always encouraged open-source softwares that can be distributed widely and can be modified. Microsoft, on the other hand, has been against it. Interesting to note is the fact that a separate technical team will be built from employees of both companies to solve the customer issues more efficiently.

http://www.businessfinancenews.com/25978-why-did-microsoft-corporation-paint-its-cloud-red/

- Teradata Plans to Sell Its $200 Million Marketing Application Business. Any Takers?

According to financial statements within the Teradata announcement, Marketing Applications revenue was down about 9% this year, which is surprising in a generally strong martech market but in line with the rest of Teradata’s business. Teradata told me separately that their marketing cloud business grew 22% year-on-year this quarter, suggesting that the decline came in the older, on-premise products and/or related services. As you may know, Teradata’s marketing applications business was a mashup of the original Teradata marketing products, developed over the past 20 years and largely on-premise, and the Aprimo cloud-based systems acquired for $525 million in 2010. The Aprimo group was dominant in the years immediately following the acquisition but control shifted back to the older Teradata team more recently. One bit of evidence: the Aprimo brand was dropped in 2013.

Photo: Josh Byers