Supplier Report: 11/7/2015

IBM purchased another company named Gravitant this week. It helps customers select cloud services from a variety of providers (and is a cloud service itself). I know I keep saying this, but IBM is consistent with their purchases: Cloud, Analytics (Big Data), and IoT. Now I want to see all the pieces put together.

And when you have it all together, then you break it apart. HPE announced the departure of their CIO on the first official business day as Hewlett Packard Enterprises. The market seems to be down on HPE at the moment, while their sister company HP Inc gained on their opening day despite concerns about the health of the PC and printer markets.

The Dell/EMC acquisition continues to befuddle me. Rumor has it that Dell is looking to sell off $10B in assets (wise move) to pay down their massive debt. They are also looking to rush a startup that EMC and VMWare (and GE) created called Pivotal to IPO to help generate additional funds. So… Dell goes private and loves it, they are buying EMC and taking them private (presumably), but they are KEEPING VMWare public, and starting another company with the EMC asset and doing an IPO… that made my fingers hurt.

IBM

- IBM’s Shopping Spree Continues As It Buys Cloud Brokerage Firm Gravitant

With Gravitant, it gets cloud brokerage, which helps companies manage cloud purchases across multiple suppliers. IBM plans to fold the new bauble into its IBM Global Technology Services unit. In addition, IBM Cloud plans to add the capabilities to its growing SaaS catalogue.

That’s like a two for one sale because Gravitant gets sold as an old fashioned service offering, and also as a SaaS product, which plays well into IBM’s overall strategy.

- The Mainframe Is a Vampire

If you looked at the recent IBM numbers, which were pretty painful but in line with what generally happens when a company is adapting to a major industry change, you saw one bright light: their mainframe business was growing faster than the server segment in general is growing.

In fact, with the massive growth of web services, it has been hard for the server segment to get out of the low single digits. But once you adjusted for currency fluctuations, mainframes (IBM’s System Z) were up a whopping 20 percent. That’d be impressive server growth in a good year, for what has been a really soft year for servers, 20 percent growth is outstanding.

http://www.datamation.com/commentary/the-mainframe-is-a-vampire.html

- Why the IBM – Weather Company purchase is a big deal (shameless plug: I cover this topic on the SourceCast podcast episode #3, which will go live tomorrow… so visit again!)

http://www.bloomberg.com/news/videos/2015-11-05/ibm-to-buy-weather-company-why-that-s-a-big-deal - IBM Watson is going to change how you think about the weather (Here is a non-video article that says similar (internet of) things)

The focus at IBM is not so much in getting Watson involved in making better weather forecasts, but in putting the world’s most famous supercomputer to work in mining epic amounts of data in order to help businesses come up with actionable insights about the weather on both a real-time and long-term basis.

EMC/Dell

- Pivotal IPO Could Make Dell-EMC Deal Even More Complicated

As a reminder, EMC owns 80 percent of VMware, which is operated and traded as an independent company. When Dell agreed to buy EMC for $67 billion last month the deal included VMware, which Dell has said it wants to continue operating in the same fashion.

Pivotal is itself a joint venture of EMC and VMware along with GE (which owns around 10 percent). The plan could call for EMC to sell about 20 percent of its ownership stake as an IPO, which is similar to what it did when it took VMware public in 2007, according to the re/code article.

If this is true, it’s just another case of this deal getting ever more muddled with multiple layers of ownership, all pointing back to Dell, which if this closes is the ultimate decider here. Let’s not forget, however that EMC has a clause in its agreement that if it gets a better offer than the $67 billion that Dell offered it, it could take that deal.

http://techcrunch.com/2015/11/03/pivotal-ipo-could-make-dell-emc-deal-even-more-complicated/

- Dell planning to sell off $10 billion in assets (rumor)

It is too early to say I called it, but keep watching for news like this…Reuters reports the PC vendor is planning this to reduce the heavy debt load it will be taking on to buy data storage company EMC for around £44 billion. In 2007, EMC sold 19 percent of VMware shares in an IPO on the New York Stock Exchange. A successful Pivotal IPO could potentially raise billions in new capital

http://financialspots.com/2015/11/04/dell-planning-to-sell-off-10-billion-in-assets-rumour/

Here is more information on the sell off providing possible asset targets:

Unnamed sources told Reuters that Dell will take on about $49.5 billion after it completes the $67 billion acquisition of EMC and its federated companies sometime next year. Selling such assets as its Quest software business (for systems management), SonicWall (network security) and AppAssure (data backup) will help the company reduce the debt load, according to the sources.

Hewlett Packard (HPE & HPI)

Note: I suspect my coverage of HP Inc will dwindle with time, but for now, I will cover both companies.

- Hewlett Packard Enterprise Loses CIO As It Charts New Course

Ralph Loura, who had served as chief information officer of the enterprise business of HP for the past 15 months, has left the company. “I had an impact while there [and] I helped design the new op model for IT, and designed myself out of it because it was what the new company needed (move from a federated model with group CIOs, to a unified/centralized model with a single CIO),” he wrote to CRN.

- Why JPMorgan Is Cautious On HP Inc (HPQ)

The skeptical view taken by the firm comes on the back of PC data, which is hardly reassuring. Seagate and Western Digital both guided for a decline in HDD TAM for the fourth quarter. Intel reported a 19% YoY decline in its PC shipments for 3QFY15 worse than the 10% decline witnessed in 2QFY15. Desktops and Notebooks posted even worse numbers and there is scarcely anything notable that stirs confidence. While HDD companies see signs of stabilization, analysts at JPMorgan are far from convinced and expect more macro instability.

http://www.businessfinancenews.com/25953-why-jpmorgan-is-cautious-on-hp-inc-hpq/

However, On Monday, the stock market reacted like this (per USA Today):

HPQ, which sells PCs and printers, soared 13%, to $13.83; HPE, responsible for commercial computer systems, software and services, fell 1.6% $14.49. Both stocks are trading on the S&P 500.

Other

- Why Billionaire Trader Stan Druckenmiller Believes In Amazon And Not IBM

“We are in a bubble in what I would call short term behavior,” Druckenmiller said. To reinforce the point Druckenmiller gave a negative assessment of IBM, which he said has missed earnings only three times over the past nine years and is in the process of buying back billions in stock, and a bullish view on Amazon.com… the difference? While IBM is cutting R&D spending against a shrinking base of sales, Amazon has doubled that spending as a percentage of sales even as they’ve grown at double digit rates. “I love Amazon. They are investing on the future,” Druckenmiller said, before quipping, “Bezos is a serial monopolist.”

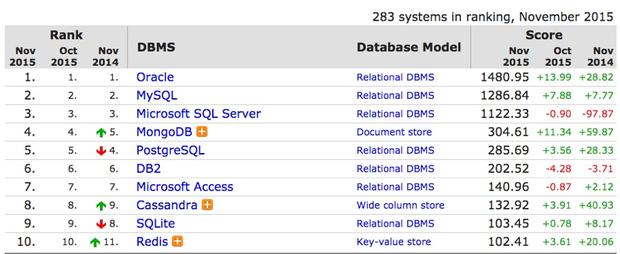

- Will NoSQL be the undoing of Oracle’s database reign?

What’s most interesting in all this is how database popularity, broadly measured, compares with Gartner’s newly released Operational Database Magic Quadrant. TechRepublic contributor Janakiram MSV has captured five big takeaways from Gartner’s report, but here’s a sixth:The database vendors that embrace NoSQL are destined to be the long-term winners.

Photo: DB-Engines http://www.techrepublic.com/article/will-nosql-be-the-undoing-of-oracles-database-reign/

- Why Did Microsoft Corporation Paint Its Cloud Red?

As part of the deal, Microsoft will feature Red Hat’s Linux as a “preferred” option for enterprise computing jobs on Azure. The deal comes in as a surprise for many as the companies have historically had differing stances on software patents and usage. Red Hat has always encouraged open-source softwares that can be distributed widely and can be modified. Microsoft, on the other hand, has been against it. Interesting to note is the fact that a separate technical team will be built from employees of both companies to solve the customer issues more efficiently.

http://www.businessfinancenews.com/25978-why-did-microsoft-corporation-paint-its-cloud-red/

- Teradata Plans to Sell Its $200 Million Marketing Application Business. Any Takers?

According to financial statements within the Teradata announcement, Marketing Applications revenue was down about 9% this year, which is surprising in a generally strong martech market but in line with the rest of Teradata’s business. Teradata told me separately that their marketing cloud business grew 22% year-on-year this quarter, suggesting that the decline came in the older, on-premise products and/or related services. As you may know, Teradata’s marketing applications business was a mashup of the original Teradata marketing products, developed over the past 20 years and largely on-premise, and the Aprimo cloud-based systems acquired for $525 million in 2010. The Aprimo group was dominant in the years immediately following the acquisition but control shifted back to the older Teradata team more recently. One bit of evidence: the Aprimo brand was dropped in 2013.

Photo: Josh Byers

Supplier Report: 10/31/2015

Oracle World happened and as expected, Hurd and Ellison made plenty of amusing remarks about their competitors. As Ellison remarked that IBM is not a competitor, big blue went out and bought the Weather Company… for $2B.

Hewlett Packard is officially and finally splitting this weekend. The two companies are facing unique market conditions in light of the Dell-EMC deal.

IBM

- IBM Will Acquire The Weather Company’s Digital Business

IBM announced this morning it’s acquiring The Weather Company, the parent company to the The Weather Channel, as well as the company’s B2B, mobile and web properties. The deal is being valued at more than $2 billion, according to a report from The Wall St. Journal. The companies are not disclosing the financial terms, however. The deal will see The Weather Company licensing weather forecast data and analytics from IBM under a long-term contract. The Weather Channel is not included in the acquisition.

http://techcrunch.com/2015/10/28/ibm-will-acquire-the-weather-companys-digital-business/

- Why does this keep happening to IBM?

For the second time in a little over two years, Big Blue faces an investigation into how it records revenue. The company disclosed on Tuesday that the SEC is looking into the “accounting treatment of certain transactions in the U.S., U.K. and Ireland.”

The stock dropped 4 percent to $137.86 after the revelation and was down 14 percent for the year at Tuesday’s close before bouncing back a bit Wednesday morning.

http://www.cnbc.com/2015/10/28/why-does-this-keep-happening-to-ibm.html

- IBM: The Line In The Sand

One of the items that is hindering IBM from making a large acquisition is the fact that the company has $32 billion in long-term debt. This is the exact time IBM needs all of its resources to try to generate revenue growth, however they will be hindered by debt maturities in 2016. The following chart fromMorningstar shows that IBM has a large number of debt maturities coming in the next five years. Specifically next year, IBM has $5 billion in debt due and while they can easily pay off the debt, it is a drain on potential cash and cash flows that could be used to invest in the business or make an acquisition.

http://seekingalpha.com/article/3609866-ibm-the-line-in-the-sand

- IBM Cloud Opens To Apache Spark

IBM will provide Apache Spark as a service onBluemix, IBM’s cloud platform. IBM will also be pushing Spark into BigInsights on Bluemix, as well as IBM’s Data Science Workbench and its SPSS Analytics Server and Modeler.

- Intel, Oracle Working Together To Take On IBM

A few months ago, the head of engineering and products at Oracle, Thomas Kurian, and Doug Fisher from Intel’s Software and Services Group decided to set up a joint team of engineers codenamed Project Apollo near Intel’s facilities in Oregon, the report said.

The team has been assigned the task of figuring out how massive cloud computing data centers could be set up that make use of Oracle’s hardware and Intel’s chips to take on IBM in the cloud computing hardware market. Project Apollo has successfully completed its mission, and the team members are now sharing “how to” documents to convince enterprise customers to use their technology in building data centers, the report said.

http://www.valuewalk.com/2015/10/intel-oracle-together-take-on-ibm/

Oracle

- Oracle’s Larry Ellison decries poor state of security, says he’s fixed it

He pointed to recent breaches including one at the U.S. government that exposed more than 20 million personnel records, and talked up new Oracle products that he said will better protect companies’ data. They include servers based on a new microprocessor, the Sparc M7, which has functions to improve security embedded in the silicon itself.

- Larry Ellison’s Keynote speech at Oracle OpenWorld 2015

- Ellison Dismisses IBM, SAP as Oracle’s Key Cloud Competitors

“Our two biggest competitors in the last two decades have been IBM and SAP, and we no longer pay any attention to either one,” Ellison said during his dinnertime keynote event. “It’s quite a shock, really, when you think about it. SAP is nowhere in cloud, and only Oracle and Microsoft are in every level of the cloud—applications, platform and infrastructure.”

http://www.eweek.com/cloud/ellison-dismisses-ibm-sap-as-oracles-key-cloud-competitors.html

Hewlett Packard (the split happens this weekend)

- Meg Whitman bets that a smaller HP will be able to beat Dell

But in the server space, Dell is waiting. With EMC, it gets the No. 1 provider of storage gear, making it a one-stop shop for corporate customers. If Dell’s strategy works, Hewlett Packard Enterprise will just continue the former HP’s fate, where sales have declined for 15 of the past 16 quarters. PC shipments, where HP is No. 2, fell 7.7 percent in the third quarter, according to Gartner. For servers, where Hewlett-Packard is the market leader, second-quarter shipments slowed to 8 percent from 13 percent in the prior period.

http://www.kansascity.com/news/business/technology/article41966259.html

- Why Hewlett-Packard Company’s Troubles May Not End With Breakup

Post breakup, there is a fair chance that the resulting HP companies will acquire to compensate for their various shortcomings. While acquisitions might add some important assets (technology and talents), any kind of acquisition comes with a certain level of risk. Integration is one of the challenges that companies meet after they acquire a new asset. History shows that many of Hewlett-Packard’s past acquisitions never happened smoothly, a problem that may carry into the resulting entities.

The other risk is that acquisitions predicated on desperation to catch up with the competition could fail to live up to expectations, be costly or unnecessarily disruptive. The two resulting HP businesses may not stay clear of these acquisition risks.

http://investcorrectly.com/20151030/hewlett-packard-company-nysehpqs-troubles-may-not-end-breakup/

EMC

- Dell acquisition of EMC could jostle Microsoft’s plans

Dell, clearly, cannot risk this in the long term. It needs an operating system of its own. VMware’s Photon Stack is a great start, but it is only a start. It would not shock me at all to see Dell buy Red Hat in the next two years. It would be the final piece of the puzzle for a fully vertically integrated play.

Microsoft doesn’t want to see that happen. And after seeing the tab for the Dell acquisition of EMC, I am sure Dell doesn’t want to spend the money either. Ample time and effort is going to be spent trying to find amicable solutions that allow both companies to coexist.

Other

- Workday Inc Becoming A Cause Of Concern To Oracle Corporation’s Cloud Business

However, Workday Inc (NYSE:WDAY) built its business on the cloud from the ground upward, giving it an edge in competition with Oracle in HR and Finance applications delivered through the cloud. Because of its nature and the steps it has already made, Workday could cause more grief for Oracle and other legacy software vendors as enterprises shift from on-premise installations to the cloud.

- Red Hat is boring — and more open source companies should emulate it

But whether such companies like it or not, the minute they base their success on an open source project, their revenue potential is hampered compared to a proprietary competitor. Sure, companies like Cloudera, MongoDB, and DataStax sell proprietary value around an open source project, but most are still somewhat constrained by their need to compete with the free project they sponsor. None of which is to suggest these companies will hurt for revenue. Rather, it’s a reminder that the best way for an open source company to grow is like Red Hat: steady, consistent, boring.

SourceCast: Episode 01: What the Dell!?!

Supplier Report: 10/24/2015

It was a rough week for the companies usually covered on this report. IBM missed earnings expectations AGAIN. The press has been brutal predicting the end of days for big blue. Rometty says she will stay the course and focus on cloud and analytics.

HP has not reacted well to the EMC news and has been trolling the acquisition in the press and with their channel customers. While they throw attention to other companies, they officially announced their decision to put the Helion cloud platform out of its misery.

Speaking of cloud, EMC announced they are creating a joint venture with VMware based on their Virtustream technology.

IBM

- IBM in Hot Water as Earnings Continue Downward Spiral

IBM has continued its down ward spiral, with revenues falling by 14 percent in the third quarter, year on year. The company’s revenues has come down to $19.28 billion in the third quarter, much lower than the $22.4 billion it earned in the third quarter last year. This is the 14th continuous quarter loss for IBM, once the doyen of computer hardware makers everywhere. The earnings have even disappointed analysts forecasts, who were expecting the company to earn $19.6 million. As expected, the markets reacted strongly and punished the company by scrapping 5.5 percent of its share price, at the end of the day.

http://www.financialbuzz.com/ibm-in-hot-water-as-earnings-continue-downward-spiral-350193

- 42 percent of IBM’s SoftLayer outbound emails found to be spam

“We believe that SoftLayer, perhaps in an attempt to extend their business in the rapidly growing Brazilian market, deliberately relaxed their customer vetting procedures,” Spamhaus suggested.

Hmmm… I didn’t know that Brazil was a spam hub… but it is (#4):

http://www.bloomberg.com/ss/09/02/0211_spam_countries/18.htm - IBM bags Wipro

Wipro, on its part, said it will train 15,000 of its developers to use Bluemix via an online open course across 58 countries. Wipro is to use over 100 services in IBM’s public Bluemix catalogue but will also use Bluemix Dedicated. That’s a private cloud version for developers to build apps that access sensitive data.

- IBM CEO Pledges to Stay the Course

Ms. Rometty said she didn’t take the decision to reduce IBM’s outlook lightly. The reason was a slowdown in what the company calls “transactional” businesses, which is shorthand for deals that require customers to make sizable upfront commitments—like big contracts for hardware, software or services contracts.

http://www.wsj.com/articles/ibm-ceo-pledges-to-stay-the-course-1445360608

- IBM Raises Eyebrows, Opens Source Code Access To China: Here’s Why

The demos are reportedly done inside a secure room without an Internet connection, where China’s IT experts view the source code on an IBM security application to prevent other people from poaching the company’s IP. Moreover, the demos are done only for a few hours, keeping anyone from thoroughly going through the code to find back doors that may have been implanted to allow the U.S. government to secretly infiltrate the system, suggesting that the demos are highly symbolic more than anything else.

EMC

- EMC and VMware Creating a Jointly Owned Hybrid Cloud Company

EMC and VMware are creating a new jointly owned hybrid cloud company that will be based on the Virtustream business that EMC acquired earlier this year. EMC and VMware officials announced the new company—which will carry the Virtustream brand—Oct. 20 during the releases of their respective quarterly earnings. The new business will be added to the list of companies that make up EMC’s federation. EMC and VMware each will own a 50 percent share of Virtustream.

http://www.eweek.com/video/emc-and-vmware-creating-a-jointly-owned-hybrid-cloud-company.html

- EMC to retain some autonomy after acquisition (this is just VMware, which everybody already knew)

EMC’s virtualization software subsidiary VMware will “remain an independent public company,” Dell said. Many of VMware’s current clients provide servers and related services, putting them in direct competition with Dell’s key operations. Fears that clients could drop VMware after it is transferred to Dell sank the former’s share price around 30% in the wake of the announcement of the acquisition.

http://asia.nikkei.com/Business/Deals/EMC-to-retain-some-autonomy-after-acquisition

HP

- HP Split Could Mean ‘Deal or Die’ for H-P Enterprise

The tax-free split of HP and Hewlett-Packard Enterprise includes an agreement that restricts deals that could undo the financial engineering and require a bill to the Internal Revenue Service. Burgess suggested the provision is effectively a poison pill that could thwart a takeover. An outright buyout of the company or a deal involving more than 50% of the stock in Hewlett-Packard Enterprise, for example, could create problems.

http://www.thestreet.com/story/13334251/1/hp-split-could-mean-deal-or-die-for-h-p-enterprise.html

- Hewlett-Packard spreading FUD over Dell-EMC merger (sharing this because I am glad someone called HP out for their lack of subtlety. If you have to FUD, do it with nuance)

Hewlett-Packard hopes to draw away enterprise data storage customers from Dell and EMC using the classic approach of spreading FUD, business shorthand for “fear, uncertainty and doubt,” about its rivals. Last week, HP CEO Meg Whitman criticized Dell’s planned $67 billion acquisition of EMC. HP later launched an opportunistic marketing campaign warning customers about potential upheaval in the storage business of the combined Dell-EMC.

- HP is giving up on competing with Amazon’s cloud (HPQ)

That’s something HP has found out the hard way, with HP Helion constantly coming under fire for being too small and too unfocused on the market to seriously make a dent. And so, HP is going to shut down HP Helion to stick with what its good at: Helping customers run their own data centers with hardware, software, and services to run at cloud levels of efficiency. The industry term for that concept is “private cloud,” and it plays into HP’s experience in servers and software.

http://www.metrowestdailynews.com/article/ZZ/20151021/BUSINESS/310219918/-1/business

Other

- IBM: Can A Red Knight Save Big Blue?

Two things excite me about Jim. First, the performance of Red Hat under his leadership. Since he became CEO of the company in January, 2008, the shares are up 275%, a market cap of $14.75 billion for a company that doesn’t really sell anything. Red Hat offers support for open source software, stuff you can download for free, yet revenues are growing at nearly 20% per year, and software engineers consider it a great place to work.

The second thing that excites me about Jim is that he has a philosophy, a way of managing his business, one that is proven to work, and one that can scale to a company of IBM’s size. I have read his book, The Open Organization and you should too. It’s a manual for 21st century software management, and software is where IBM needs to be.

http://seekingalpha.com/article/3589406-ibm-can-a-red-knight-save-big-blue

Photo: Pavel Badrtdinov