Supplier Report: 10/22/2016

Big IT firms are clearly focused on the cloud, but as these companies grow out their infrastructure, we will focus on the differences between the cloud providers and try to find sweet spots.

SalesForce had some very sensitive M&A information leaked. Will Pega Systems and Tableau get bought or was this some kind of trick to drive up stock prices?

And are the days of the Chinese factory workers numbered?

Acquisitions

- Wipro To Buy Salesforce Superstar Appirio for $500 Million

Business process services goliath Wipro says it will spend half a billion dollars to purchase cloud services powerhouse Appirio so it can improve its market share and position around Salesforce and Workday.

The $500 million all-cash acquisition is expected to close by the end of the year, according to a statement. Wipro did not immediately respond to a request for additional comment.

- Salesforce.Com, Inc To Buy Tableau Software Inc (NYSE:DATA) Shortly After Declining Twitter Inc Buyout

Tableau Software Inc. explored a potential sale in recent months, according to people familiar with the matter, as technology companies scramble for partners amid a wave of mergers in the industry.

The Seattle company was working on a potential sale as recently as this summer before the effort stalled, the people said.

The Wall Street Journal reported on the document in a front-page article Wednesday that pushed up shares of Tableau as much as 7%, giving it a market value of nearly $4 billion.

http://www.nasdaq.com/article/software-maker-tableau-explored-a-sale–wsj-20161020-00076

- HP Enterprise services merger with CSC could ‘mean more churn’ for company’s federal contractors

“The combination of these two companies will create a new company with billions in global revenue, including a sizable U.S. federal government business,” it added. “However, the government sector of the new, yet unnamed company may be impacted by the cost take-outs planned by the merger and the distraction of yet another major company reorganization.”

- Salesforce’s M&A Target List Had 14 Names, But Not Twitter Inc

Citing an internal presentation allegedly obtained from former Secretary of State and Salesforce Director Colin Powell the WSJ lists 14 companies, including Marketo, Adobe Systems, Hubspot, PegaSystems, Demandware, Tableau, and LinkedIn, as possible candidates.

According to the presentation, Box and Zendesk were mentioned as well, but their chief executives had less interest. The presentation, which was marked “draft and confidential” and titled “M&A Target Review,” is a 60-slide document which identified 14 possible acquisition targets.

http://www.valuewalk.com/2016/10/salesforces-list-14-names-not-twitter/

Artificial Intelligence

- DeepMind’s differentiable neural computer helps you navigate the subway with its memory

DeepMind’s technique merges notions of memory with more traditional neural networks using a “controller.” The controller saves information by either storing it in a new location or overwriting a previously occupied location. Throughout this process, an association between the information is formed via the timeline of when new data was written in.

The controller uses that same chronology along with the actual content of what has been saved to retrieve information. The framework created is navigable and proves itself effective for drawing insights from graph data structures.

- Fighting Diabetes with Watson: Medtronic and IBM Health

- No More Humans: Foxconn Deploys 40,000 Robots In China

Dai said currently Foxconn can produce 10,000 robots annually. In the future, those robots are all potential replacements for human labor. For the Kunshan factory alone, Foxconn has cut 60,000 employees.

Prior to this, labor costs in mainland China were lower than robots; therefore, Foxconn maintained nearly one million workers. However, with the increase of labor costs and the younger generation’s lack of interest in production line work, many companies have launched huge investments in automation.

https://www.chinatechnews.com/2016/10/13/24329-no-more-humans-foxconn-deploys-40000-robots-in-china

What I predicted in this post is starting to come true - IBM Watson Will Run On IBM and IBM Alone

You’ve got to give UBS analyst Steven Milunovich major props. During IBM’s earnings call on Monday, he asked whether IBM Watson, the company’s golden child, will run on rival Amazon Web Services—and he was promptly shot down. “No. Watson runs on our cloud, and our technology will run on IBM’s cloud,” IBM chief financial officer Martin Schroeter responded tersely.

Cloud

- Cloud Pricing and Performance Questions Add to IT Buyer Uncertainty

The RBC test results come as IT executives face confusion over exactly what constitutes “cloud” and how different providers account for it. “If you’re trying to figure out which vendor to go with for cloud services, claims about being number one in the market or having high cloud revenue should be ignored,” Gartner Vice President David Mitchell Smith told a group of CIOs gathered in Orlando for the researchers annual enterprise IT convention. “You can’t compare these things because there are no standards.”

- What’s better: Amazon’s Availability Zones vs. Microsoft Azure’s regions

AWS uses what are called Availability Zones (AZs) as the basis for its cloud. Each region in AWS is made up of at least two AZs. Microsoft, instead, just uses regions; it does not guarantee that each region will have multiple data centers. It’s a fundamental difference in the way these IaaS platforms are constructed. And it begs the question: Is one way better than the other?

Also:

AZs come with some downsides though, Wray adds. If an AZ has an outage, many customers have designed their workloads fail over to another AZ in that same region. If all of the customers in the downed AZ transfer workloads to the healthy AZ, that could theoretically create a crowded AZ, which could impact performance.

- Rival tech companies trade hostility for hugs

The cloud storage market is dominated by a few major firms: AWS, Microsoft, IBM and Google collectively control well more than half the worldwide cloud infrastructure services market, Synergy Research Group estimates. Analysts at Forrester predict that AWS will produce $12 billion this year, more than half of all the revenue the entire public cloud market is expected to generate.

- CIA CIO: Amazon Web Services is key to developing secure apps

In time, the migration to cloud storage is expected to decrease DHS’s reliance on in-house data centers. This shift is also augmented by a growth in effective security technology layered over those same vendor-built cloud systems, said Edwards, who specifically referenced Amazon Web Services’ increased ability to meet the agency’s high bar for defenses.

https://www.cyberscoop.com/cia-cio-amazon-web-services-key-developing-secure-apps/

- The downside of the cloud: Netflix is down, so is Spotify and Twitter

Netflix and Twitter were amongst an array of websites and services taken down this morning by a DDoS attack. This list of sites and services also appears to have included SoundCloud, Disqus, PayPal, Spotify, and Reddit. Spotify reported issues to the public starting at 8AM Central time this morning, the 21st of October, 2016.

http://www.slashgear.com/netflix-is-down-so-is-spotify-and-twitter-21461133/

Datacenter

- IBM and other giants to reform servers and make them faster

Servers current circuitry is not fast enough, and International Business Machines Corp. has promised to speed the data transfer in servers up to ten times. The group hopes more companies will be part of the team to improve servers speed. Standard microprocessors are getting faster, but their performance is usually delayed because they need to fetch data from nearby memory chips, graphic chips or other elements used to handle certain tasks.

http://www.pulseheadlines.com/ibm-giants-reform-servers-faster/52692/

- Lenovo’s attack plan against Dell EMC? A partnership with Nimble Storage

The Chinese company, which has what it calls its “dual” headquarters in Morrisville and its server division in Research Triangle Park, just signed a deal with Nimble that allows it to sell Nimble’s all-flash array technology, as well as to use the firm’s predictive analytics capabilities.

Also:

And it’s a segment of the business that has seen major change, particularly as its relationship with longtime partner EMC severed completely when rival technology firm Dell acquired it. Since Dell announced the buy last year, Lenovo has been working to fill the gap. McRae says it’s been a systematic effort.

http://www.bizjournals.com/triangle/news/2016/10/17/lenovo-nimble-storage-partnership.html

Other

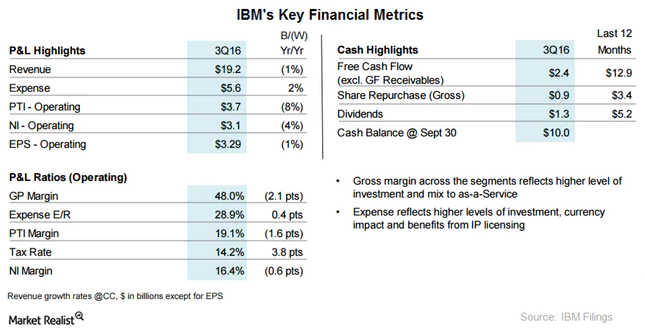

- IBM Shares Fall Despite Higher-Than-Expected Sales

Revenue from those areas, which the company calls “strategic imperatives,” rose 16% to $8 billion in the third quarter. Cloud revenue jumped 44% compared with a 30% rise in the second quarter, it said. However, shares of IBM, which reported its 18th straight quarter of declining revenue, were down 3.1% at $150.60 in after-market trading.

http://fortune.com/2016/10/18/ibm-shares-fall-beat-estimates/

- HP: We’ll Put Laid-Off Workers on Contract

In light of massive job cuts, HP Inc. has indicated to Business Insider that it may offer affected workers the opportunity to continue their roles as employees at contract agencies. The company stated, “HP has a strong record of success in placing employees in outsourced roles to mitigate the headcount number.” HP has a track record of shifting employees to positions as contract workers from before its 2015 split with Hewlett Packard Enterprise Co.

http://www.investopedia.com/news/hp-well-put-laidoff-workers-contract-hpq/

- HP Enterprise announces more layoffs as cloud business struggles

The layoffs in the Stackato may indicate HPE is further retreating from the ultra-competitive cloud market amidst tough competition from AWS and Microsoft. Last year, HPE pulled the plug on its Helion hybrid cloud offering. In August, Bill Hilf, HPE’s current cloud leader,announced he was leaving the company to “pursue other opportunities.”

http://www.ciodive.com/news/hp-enterprise-announces-more-layoffs-as-cloud-business-struggles/428563/

- Microsoft employees love Satya Nadella a lot more than they did Steve Ballmer

Microsoft CEO Satya Nadella looks especially good, by the report’s reckoning. At the close of 2013, the final days of former chief executive Steve Ballmer’s reign, Microsoft only gave a 51% rating for CEO approval. Nadella took the reigns in February 2014, and the CEO approval rating hit 88% by the end of 2015.

http://www.businessinsider.com/microsoft-employees-love-satya-nadella-2016-10

- Broadcom, Harris Vet Bill Miller Joins NetApp as CIO

Bill Miller, former senior vice president and chief information officer at Broadcom, has joined NetApp in the same role of CIO and will be responsible for both the company’s information technology organization and ongoing transformation initiatives.

http://www.govconexecutive.com/2016/10/broadcom-harris-vet-bill-miller-joins-netapp-as-cio/

Photo: Rob Roy

Supplier Report: 10/15/2016

Large IT companies are running into some M&A trouble. Verizon wants a discount on their Yahoo acquisition, Saleforce is trying to block the Microsoft’s purchase of Linkedin, and Oracle is struggling to make their purchase of Netsuite a reality.

Cloud was a big topic this week – Google has officially rebranded their cloud offerings as “Google Cloud” due to customer confusion (good move), IBM CEO Ginni Rometty explains her company’s position on blockchain (and discusses if AI can replace her), and VMWare is available on AWS.

HP Inc is cutting 4,000 jobs but former EMC CEO Joe Tucci found one!

Acquisitions

- Verizon wants $1 billion discount after Yahoo privacy concerns

“The key will be what was actually disclosed by Yahoo before signing,” Frank Aquila, legendary M&A lawyer and partner at Sullivan & Cromwell tells TechCrunch. “No one should be surprised that Verizon wants a significant reduction.”

- It looks like Marc Benioff does have reason to worry about the LinkedIn-Microsoft deal

Salesforce has been complaining to the European Commission about Microsoft’s purchase of LinkedIn. It is worried that Microsoft will block access to LinkedIn’s vast store of professional data and it wants the EU to either block the acquisition (unlikely) or put conditions on the deal (unlikely but more plausible).

- Salesforce CEO Benioff’s decision to walk away from Twitter is the right one

Investors breathed a sigh of relief but were probably also thinking, “told you so.” After the initial reports of Benioff’s interest in Twitter last month, the deal was panned by almost everyone, from Wall Street analysts to the media to Salesforces’s biggest investors. Salesforce stock is up 6% on the news.

- Oracle Wins Injunction, Extends Final Tender Offer for Netsuite

Meanwhile, Oracle recently extended the expiration date of its tender offer for NetSuite acquisition to Nov 4. The company stated that this is the final extension and “In the event that a majority of NetSuite’s unaffiliated shareholders do not tender sufficient shares to reach the minimum tender condition, Oracle will respect the will of NetSuite’s unaffiliated shareholders and terminate its proposed acquisition.”

Artificial Intelligence

- Could Watson Replace Ginni Rometty? What She’s Not Saying About AI, Jobs & Disruption

IBM has bet it’s future on AI, cloud computing and data/information/knowledge management. All three areas are about reducing costs and improving productivity by decreasing human labor.Cloud computing, for example, could easily be described as the technology delivery model that kills software developers, applications support professionals and data center managers. There’s a straight line from the number of jobs IBM eliminates and its stock price. If Watsonbecomes a friendly assistant that charges for its pedantic services, IBM will fail. But if Watson enables large-scale labor replacement, IBM’s stock will rise.

- Artificial intelligence positioned to be a game-changer (follow link for the video)

One of the technologies just hatched is called Gabriel. It uses Google Glass to gather data about your surroundings and advises you how to react. It’s like an angel on your shoulder whispering advice or instructions. In this case trying to direct us how to win a game of ping pong but the possibilities go beyond bragging rights.

http://www.cbsnews.com/news/60-minutes-artificial-intelligence-charlie-rose-robot-sofia/

Cloud

- IBM wins $62 million contract to run private cloud pilot at Army’s Redstone Arsenal

IBM won the work as a task order under the Army’s Private Cloud II indefinite delivery/indefinite quantity contract. The $62 million award includes one base year and four option years, during which the company will build, then own and operate a data center on Army property at Redstone Arsenal, near Huntsville, Alabama.

- VMware and AWS Announce New Hybrid Cloud Service, “VMware Cloud on AWS”

Amazon and VMWare today announced a strategic alliance to build and deliver a seamlessly integrated hybrid offering that will give customers the full software-defined data center (SDDC) experience from the leader in the private cloud, running on the world’s most popular, trusted, and robust public cloud. VMware Cloud™ on AWS will enable customers to run applications across VMware vSphere®-based private, public, and hybrid cloud environments. Delivered, sold, and supported by VMware as an on-demand, elastically scalable service, VMware Cloud on AWS will allow VMware customers to use their existing VMware software and tools to leverage AWS’s global footprint and breadth of services, including storage, databases, analytics, and more

- IBM CEO Rometty’s position on blockchain

Good to hear IBM’s direct stance on the platform and what their vision is - IBM’s Cleversafe storage platform is becoming a cloud service

Cleversafe’s innovation in object storage was to combine encryption with erasure coding and geographic dispersal of data. SecureSlice encrypts unstructured data, stores the key with the data, and then breaks up that data and puts it on several different storage nodes. In IBM Cloud Object Storage, those nodes can be in data centers spread across an entire continent.

- Google’s Diane Greene providing a status on Google’s cloud platform:

- IBM says its new Cloud Object Storage allows easily moving and splitting data

The service is built on technology dubbed SecureSlice, which combines encryption, erasure coding and geographic dispersal of data. Erasure coding is a form of data protection. IBM acquired the SecureSlice technology when it bought Cleversafe last year for $1.3 billion. The technology automatically encrypts each segment of data before it’s erasure-coded and dispersed, and the data can only be reassembled where it was originally received.

http://www.geekwire.com/2016/ibm-says-new-cloud-object-storage-allows-easily-moving-splitting-data/

- Amazon cloud boss Andy Jassy fires back at Oracle’s Larry Ellison, says stats were ‘made up’

Instead, Jassy pointed to what analysts are saying about AWS. For example, Gartner said in its Magic Quadrant report last year that AWS is 10-times bigger than its next 14 competitors combined, while putting it at the top of the list against this year.

Deutsche Bank also wrote in a recent note, “Oracle talked up its ‘next-gen’ infrastructure as a cheaper rival to AWS, but we don’t believe it will be competitive anytime soon.

Datacenter

- IBM, Google, others to unveil new open interface to take on Intel

The new standard, called Open Coherent Accelerator Processor Interface (OpenCAPI), is an open forum to provide a high bandwidth, low latency open interface design specification.

The open interface will help corporate and cloud data centers to speed up big data, machine learning, analytics and other emerging workloads.

The consortium plans to make the OpenCAPI specification available to the public before the end of the year and expects servers and related products based on the new standard in the second half of 2017, it said in a statement.

http://www.reuters.com/article/us-technology-consortium-idUSKCN12E0C5

- Dell shows off new logo…

This looks like something Silicon Valley would do to make fun of an IT company.

Other

- Joe Tucci Named Chairman of Bridge Growth Partners

Bridge Growth Partners, LLC, a sector-focused, growth-oriented private equity firm, today announced that Joseph M. Tucci, former Chairman and Chief Executive Officer of EMC Corporation and former Chairman of VMWare, has been named Chairman of the firm. Tucci has served on the firm’s Investment Committee and Advisory Board since Bridge Growth Partners was established in late 2013.

- Hewlett Packard Enterprise will have approximately $9 billion in net cash at the end of FY17

Hewlett Packard Enterprise is expected to host analyst meeting event on October 18, and according to Mr. Hosseini, the management will surely divulge information regarding the high level of cash in the company’s balance sheet. Furthermore, the analyst expects insight regarding growth initiatives and the strategy used by the company in order to promote secular growth trends in key areas of business.

- HP Inc will cut up to 4,000 jobs by 2019

The world’s second-largest PC supplier has struggled in a dwindling market, and hopes the cutbacks will save the company between $200 to $300 million annually by 2020.

However, HP will also incur an estimated $350 million to $500 million in restructuring costs.

The announcement comes during a global decline in PC sales, dropping 5.7% in the third quarter compared to last year according to a report by Gartner. This represents the longest period of decline in the history of the PC industry.

http://www.itpro.co.uk/strategy/27410/hp-will-cut-up-to-4000-jobs-by-2019

Photo: Tao Wen

Supplier Report: 10/8/2016

Nobody wants to buy Twitter, but that isn’t stopping SalesForce, Google, and Microsoft with moving forward with their long term plans.

Internet of Things is trending this week as Microsoft is quietly shutting down their fitness band division, but will they buy FitBit (and what would they do with all of that data)? IBM is dropping $200M on a new IoT HQ in Germany.

There were also a few interesting team-ups this week: VMWare and Amazon on some potential VMWare options on AWS and IBM and AT&T deepening their relationship via cloud services.

Acquisitions

- Plat.One acquisition marks start of $2B IoT investment plan for SAP

SAP has bought IoT software developer Plat.One, marking the start of a plan to invest US$2 billion in the internet of things over the next five years.

Some of those billions will be spent on the creation of IoT development labs around the world, SAP said Wednesday. It already has plans for such labs in Berlin, Johannesburg, Munich, Palo Alto, Shanghai and São Leopoldo in Brazil.

The company is also rolling out a series of “jump-start” and “accelerator” IoT software packages for particular industries, to help them monitor and control equipment.

- Salesforce snaps up Krux for $700M on eve of Dreamforce

On the eve of Dreamforce, his company’s annual developers shindig, Salesforce agreed on Monday to acquire Krux, a marketing-data start-up, for $700 million in stock and cash. Krux, which already has a partnership with Salesforce, is expected to bolster Salesforce’s ability to better identify and serve its cloud-software customers.

http://www.usatoday.com/story/tech/2016/10/03/salesforce-snaps-up-krux-700m-eve-dreamforce/91490708/

- Salesforce Investors Could Derail a Potential Deal for Twitter

During a CNBC interview on Wednesday with Jim Cramer, Benioff neither confirmed nor denied Salesforce’s interest in Twitter, but didn’t exactly sound as if a deal is certain. “We have to look at everything, we’re going to pass on most things,” he said. Salesforce, which was down over 7% at one point, pared its losses a little following Benioff’s remarks.

The fact that Twitter is already often used as a marketing and customer service vehicle by many companies — including, presumably, many Salesforce clients — probably isn’t lost on Benioff. Salesforce likely sees value in integrating Twitter with its Marketing Cloud (online marketing automation) and Service Cloud (customer service and enterprise collaboration) software. It also could leverage data on Twitter activity to give clients a better understanding of their customers, as well as engage with them more effectively.

https://www.thestreet.com/story/13843028/1/salesforce-investors-could-derail-a-potential-deal-for-twitter.html

Salesforce Should Leave This Bird in the BushA Wall Street Journal report late Tuesday makes clear that Salesforce is still very interested. CEO Marc Benioff has reportedly been talking up Twitter behind closed doors—going so far as to describe the troubled microblogging service an “unpolished gem” at one gathering. Salesforce shares fell another 5% as a result. In all, the prospect of buying Twitter has erased nearly $5 billion in Salesforce’s market value.

http://www.wsj.com/articles/salesforce-should-leave-this-bird-in-the-bush-1475696224

- Should Microsoft Buy Fitbit?

Fitbit isn’t for sale, but that doesn’t mean it can’t be bought. There wasn’t a “For Sale” sign hanging on Skype, Yammer, and more recently LinkedIn when Microsoft cracked open its huge pocketbook to snap up niche leaders. This makes Fitbit a logical target for a company with a history of multi-billion dollar purchases and a market leader that is attainable. Fitbit’s present enterprise value of $2.5 billion would be a light bite for Microsoft, even with a reasonable premium on top of that.

http://www.fool.com/investing/2016/10/06/should-microsoft-buy-fitbit.aspx

- Oracle Threatens to End NetSuite Deal

On Friday, Oracle announced that it extended the expiration data of its tender offer for NetSuite to Nov. 4, having already extended the date to Oct. 6 last month “to facilitate the completion of outstanding antitrust reviews.” In September, Oracle received the final antitrust clearance needed, from the U.S. Department of Justice.

Artificial Intelligence

- Majesco, IBM Partner on Cloud, AI for Insurers

The joint offering is the first under IBM’s recently announced Industry Platforms division. IBM and Majesco’s offering will provide insurers with a way to launch predictive-analytics driven products and services quickly, the companies say.

IBM will open up an API for Watson, its cognitive computing platform, which insurers can use to analyze, price and understand business risks better. Watson can also help insurers deploy automated advisory interfaces.

- Thomas Jefferson University Hospitals Plans Cognitive Hospital Rooms powered by IBM Watson Internet of Things

The in-room speakers will be connected to the IBM Watson IoT Platform that taps IBM Watson cognitive computing and natural language capabilities, as well as provides the ability to easily access hospital data that is relevant and important for patients and the types of questions they typically may have about their hospital stay.

Cloud

- IBM, AT&T broaden partnership through cloud-networking arrangement

IBM to utilize AT&T FlexWare, a solution tailored for setting up and managing virtual network functions. AT&T’s value from the partnership is intended to derive from access to IBM’s sales and marketing teams along with the ability to run applications on IBM infrastructure (cloud, cognitive, analytics, security).

http://seekingalpha.com/news/3212756-ibm-t-broaden-partnership-cloud-networking-arrangement

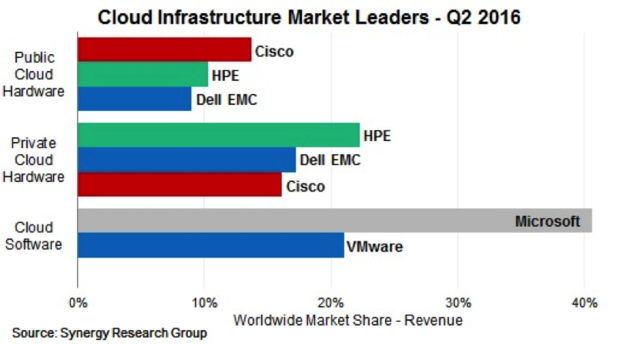

- Why the cloud is bad news for Cisco, Dell, and HP

Yes, private cloud is almost certainly a transition phase for enterprise computing, wherein risk-averse CIOs tiptoe toward true public cloud computing. Commenting on this point, analyst Curt Monash declares it is now “widely understood” that “due to economies of scale, only a few companies should operate their own datacenters.”

Yet many still do, believing that certain workloads are simply inimical to public cloud infrastructure. As such, HPE, Dell EMC, and Cisco each took a sizable chunk of the private cloud server market:

- Microsoft Azure cuts prices on its virtual machines

General-purpose Dv2 VMs, which offer a CPU that Microsoft says is about 35 percent faster than that found in the basic D series, are now 15 percent less expensive. The basic A1 and A2 VMs — members of the A series, which can be deployed on a variety of hardware types and processors — are now up to 50 percent cheaper.

http://www.geekwire.com/2016/microsoft-azure-cuts-prices-virtual-machines-amazon-gives-away/

- IBM says IoT investments are about to pay off

IBM will invest $200 million in a new headquarters in Munich for its IoT business, the company announced Monday — the latest investment in IoT by the computer giant.

http://www.ciodive.com/news/ibm-says-iot-investments-are-about-to-pay-off/427512/

- Why blockchain is big business for IBM in Research Triangle Park

And it’s particularly relevant in the banking and financial markets where 15 percent of banks intend to implement commercial blockchain solutions in 2017. According to an IBM study, about 65 percent of banks expect to have blockchain solutions in production in the next three years.

“We’re seeing a lot of interest from our banking customers, more than we can keep up with,” she says.

- Frenemies? VMware And Amazon To Team On Cloud

Details are sketchy, but sources close to both companies confirmed to Fortune the gist of the announcement will be made in San Francisco next Thursday by Amazon Web Services Chief Executive Andy Jassy. It’s likely that his VMware counterpart, Pat Gelsinger, will also be on hand. Neither company could be immediately reached for comment on this story.

http://www.crn.com/news/cloud/300082332/frenemies-vmware-and-amazon-to-team-on-cloud.htm

Datacenter

- The Job Cuts Begin: Dell Confirms Layoffs

“Most cuts are overlap, none strategic and/or not part of the new Dell EMC program. To me very normal and a must once the two firms begin to integrate, gel, morph and then execute as a new technology powerhouse with a focused team that [has] the ‘right’ skill sets to address this new world,” Shepard wrote.

http://www.crn.com/news/channel-programs/300082351/the-job-cuts-begin-dell-confirms-layoffs.htm

- Why Red Hat, Inc. Gained 11% in September

The open-source software specialist saw second-quarter earnings rise 17% year over year, based on 17% stronger sales. Both of these figures were above Wall Street’s consensus estimates. Application development tools led the way with 33% higher sales, and Red Hat customers’ adoption of long-term support subscriptions is pacing ahead of the basic revenue growth.

http://www.fool.com/investing/2016/10/07/why-red-hat-inc-gained-11-in-september.aspx

Software/SaaS

- Oracle Will Keep Posting Growth in the SaaS Space

As we discussed earlier in this series, Microsoft (MSFT) emerged as the leader of overall enterprise SaaS (software-as-a-service) space, and Salesforce (CRM) continues to rule the CRM (customer relationship management) space. It was the Oracle’s dominance in ERP (enterprise resource planning), the segment that grew the most in the SaaS space, that led it to register the highest growth in the SaaS space in 2Q16.

http://marketrealist.com/2016/10/oracle-will-continue-post-growth-saas-space/

Other

- IBM Brand Value Collapses 19%

The failure of IBM’s turnaround continues to smother the business. IBM’s shares are off 17% in the past two years, against a 9% improvement in the S&P 500. IBM’s revenue in 2011 was $106.9 billion. In 2015, the figure fell to $81.7 billion.

http://247wallst.com/technology-3/2016/10/05/ibm-brand-value-collapses-19/

- SAS CEO Dr Jim Goodnight on the power of big data, literacy and philanthropy

“We spend 25 per cent of our revenues on R and D every year, which is more than any other major software company,” says Goodnight, who was a statistics professor at the North Caroline State University when he started working on software for agriculture.

- Coupa up 87% in software IPO

But they’re still not profitable. For the six months ending in July, Coupa lost $24.3 million, which compares to a loss of $25.1 million in the same period last year. Yet revenue is growing, up to $53.2 million from $31.6 million in the same time frames.

CEO Rob Bernshteyn tells us they are more focused on their margins than profitability right now. “For every dollar we burned, we created well over a dollar in recurring revenue,” he told TechCrunch. He says he’s looking to “build this business for the long-term.”

https://techcrunch.com/2016/10/06/coupa-up-87-in-software-ipo/?ncid=rss