Amazon was all over the news this week. There is still fall out from the company’s decision to pull back from NYC, there are grumblings about Bezos’ divorce impacting operations (and ownership), and they announced they are opening grocery stores… separate from the Whole Foods brand.

Meanwhile, Microsoft is introducing some very cool Excel scanning technology and Google is optimizing wind energy in their data-centers.

Acquisitions

- Web Content-Recommendation Firm Outbrain to Acquire Native-Ad Specialist

New York-based Outbrain has agreed to purchase the Cologne, Germany-based firm, in an all-stock transaction. The deal’s financial terms weren’t disclosed.

The acquisition, which Outbrain says is its largest ever, is meant to help the company capture more of the market for native advertising, or ads that mimic the look and feel of the content around them. Ligatus operates a so-called supply-side platform that helps publishers sell native ads.

Companies like Outbrain, whose recommendations often appear at the bottom of news articles, have faced criticism for promoting low-quality content.

Artificial Intelligence

- Machine learning can boost the value of wind energy

Using a neural network trained on widely available weather forecasts and historical turbine data, we configured the DeepMind system to predict wind power output 36 hours ahead of actual generation. Based on these predictions, our model recommends how to make optimal hourly delivery commitments to the power grid a full day in advance. This is important, because energy sources that can be scheduled (i.e. can deliver a set amount of electricity at a set time) are often more valuable to the grid.

Although we continue to refine our algorithm, our use of machine learning across our wind farms has produced positive results. To date, machine learning has boosted the value of our wind energy by roughly 20 percent, compared to the baseline scenario of no time-based commitments to the grid.

https://www.blog.google/technology/ai/machine-learning-can-boost-value-wind-energy/

Cloud

- Lyft has to pay Amazon’s cloud at least $8 million a month until the end of 2021

Buried in there is the revelation that Lyft is contractually obligated to pay at least $300 million to Amazon Web Services (AWS), Amazon’s market-leading cloud-computing business, between January 2019 and December 2021. Some quick napkin math shows that — depending on when exactly the contract began in January 2019 and ends in December 2021 — Lyft is committed to spending between $8.33 million and $8.57 million a month on AWS, which hosts its entire app and platform.

Notably, Lyft said that if its usage of Amazon’s cloud doesn’t hit or exceed that $300 million threshold, it’ll have to pay the difference. Lyft committed to spending at least $80 million in each of the three years of the deal, with the stipulation that it will spend $300 million in aggregate overall.

https://www.businessinsider.com/lyft-ipo-amazon-web-services-2019-3

- AWS chief Andy Jassy says it’s ‘really easy to cut prices’

“It’s actually really easy to lower prices,” Jassy told Jim Cramer on CNBC’s “Mad Money” on Thursday. “It’s much harder to be able to afford to lower prices.” In the past decade, AWS has cut prices 70 times, he said.

Other key areas where Amazon tries to stay ahead of the competition include geographic reach and the variety of tools that are available.

“We’re much more focused on the long term than most companies,” Jassy said. “We are trying to build a business and a set of customer relationships that outlasts all of us. And as such, we think if we help our customers get more done and are successful on their own, even if it means lower margin percentages, over time we’ll drive more absolute margin dollars, and they’ll be more successful, and we’ll ultimately be more relevant.”

https://www.cnbc.com/2019/02/28/aws-ceo-andy-jassy-its-really-easy-to-lower-prices.html

Hey Andy – tell that to Lyft

Software/SaaS

- Microsoft Excel will now let you snap a picture of a spreadsheet and import it

Microsoft is adding a very useful feature to its Excel mobile apps for iOS and Android. It allows Excel users to take a photo of a printed data table and convert it into a fully editable table in the app. This feature is rolling out initially in the Android Excel app, before making its way to iOS soon. Microsoft is using artificial intelligence to implement this feature, with image recognition so that Excel users don’t have to manually input hardcopy data. The feature will be available to Microsoft 365 users.

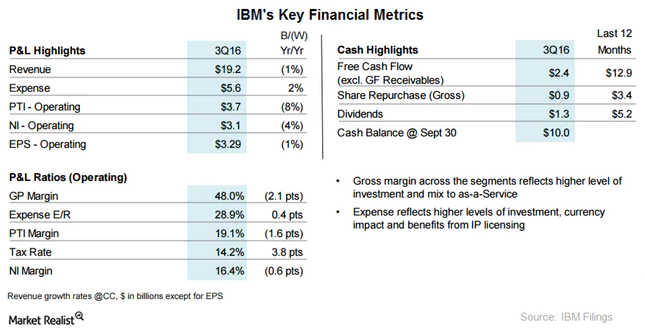

- Warren Buffett says he ditched his stake in Oracle because of his experience getting burned by IBM

“[Cofounder and CTO] Larry Ellison’s done a fantastic job with Oracle. I mean I’ve followed it from the standpoint of reading about it. But I felt like I didn’t understand the business,”

“Then, after I started buying it, I felt I still didn’t understand the business. I actually changed my mind in terms of understand and not in terms of evaluating it. I think, I mean, Oracle is a great business. But I don’t think, particularly after my experience with IBM, I don’t think I understand exactly where the cloud is going.

“You know, I’ve been amazed at what Amazon has done there. And now Microsoft is doing it as well. So I don’t know where that game is going.”

https://www.businessinsider.com/warren-buffett-oracle-ibm-2019-2

- Accenture Works With Mastercard, Amazon to Boost Circular Supply Chain Using DLT

Within the announced initiative, Accenture is collaborating with major global companies including cloud computing firm Amazon Web Services, blockchain supply chain firm Everledger, international development organization Mercy Corps and multinational financial services corporation Mastercard.

According to the release, the new blockchain-enabled circular supply chain capability will allow customers to identify small-scale suppliers and growers on the supply chain and make rewards by using direct payments.

Additionally, the new capability is designed to provide better management of inventory and waste elimination, transparency across the supply chain and authenticity of products.

Datacenter/Hardware

- HP Sales Rise, but Fall Short of Estimates

HP Inc.’s sales missed Wall Street targets in the most recent quarter, weighed down by the weaker-than-expected sales of printing supplies to commercial customers. Revenue from the printing segment, which includes the supplies business, fell to $5.06 billion from $5.08 billion a year earlier.

Meanwhile, sales in the personal-systems segment, which includes its PC business, rose 2.3% to $9.66 billion, also missing analysts’ expectations. Total units sold fell 3% from the year earlier, as notebook units sold declined 1% and sales of desktops fell 8%, HP said.

Overall, HP reported a first-quarter profit of $803 million, or 51 cents a share, down 59% from the year earlier, when the Palo Alto, Calif., company got a boost from the U.S. tax overhaul. Excluding restructuring charges and other items, profit was in line with analysts’ estimates at 52 cents a share, up from 48 cents a share a year earlier.

https://www.wsj.com/articles/hp-sales-rise-but-fall-short-of-estimates-11551301659

Other

- WeWork confirms it has laid off 300 employees

Headquartered in New York, the layoffs were performance-related, part of the company’s routine process of shedding underperformers. Among the departments impacted by the cuts were WeWork’s engineering team, product and user experience design.

“Over the past nine years, WeWork has grown into one of the largest global physical networks thanks to the hard work and dedication of our team,” the company said in a statement provided to TechCrunch. “WeWork recently conducted a standard annual performance review process. Our global workforce is now more than 10,000 strong, and we remain committed to continuing to grow and scale in 2019, including hiring an additional 6,000 employees.”

https://techcrunch.com/2019/03/01/wework-confirms-it-has-let-go-of-300-employees/

- Amazon to Launch New Grocery-Store Business

The new stores aren’t intended to compete directly with the more upscale Whole Foods stores and will offer a different variety of products, at a lower price point, these people said. Whole Foods doesn’t sell products with artificial flavors, colors, preservatives and sweeteners, among other quality standards.

Suppliers with big brands have hoped to have inroads into Whole Foods since Amazon bought the chain nearly two years ago. While Whole Foods has gradually expanded the big brands it carries—such as Honey-Nut Cheerios and Michelob beer—a conventional grocer can carry a much larger assortment of items.

Amazon has had mixed results with its food-delivery business, and it wants to better understand how it can cater to grocery shoppers, according to people briefed on the company’s strategy.

Photo by nrd on Unsplash