EMC and Dell are in some rough waters with the IRS. Will their creative use of “tracking shares” be able to keep their deal afloat or will it crash and sink the mega-purchase?

On the topic of purchases, IBM finalized the acquisition of two companies: Meteorix & Cleversafe. Outside of that news, it was a fairly quiet week for big blue, with standard articles (at this point) of the medical research potential of Watson.

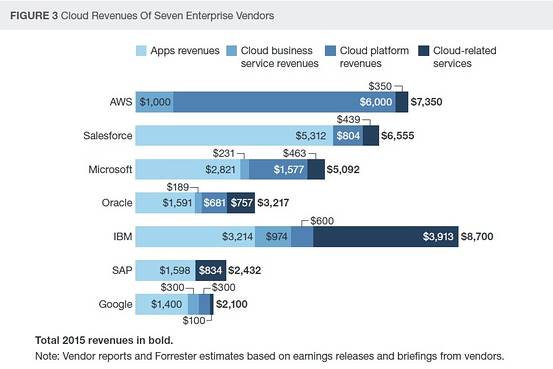

Oracle is getting good press about their cloud attempts and the fact that they are going after Amazon hard. Will they win? Who knows, but the spectators are excited to see this fight happen.

IBM

- IBM adds two new company acquisitions

They finalized Meteorix:Yesterday, IBM announced that it has closed a deal to acquire Meteorix LLC, a premier Workday services partner.

They also finalized the acquisition of Cleversafe

Last week, IBM announced that it closed a deal to acquire Cleversafe, Inc., a leading developer and manufacturer of object-based storage software and appliances. According to a statement from IBM, the acquisition will strengthen IBM’s leadership positions in storage and hybrid cloud and support clients’ drive to next generation mobile, social and analytics applications.

http://wraltechwire.com/ibm-adds-two-new-company-acquisitions/15102318/

- Watson to help kids battling rare diseases

IBM’s cognitive learning platform will be integrated into Boston Children’s Hospital to help researchers at the Manton Center for Orphan Disease Research in their study of steroid-resistant neophrotic syndrome (SRNS), a rare genetic form of kidney disease. Watson will first scour all available literature and related information on SRNS, then be used to process genomic data from patients at Boston Children’s to help researchers identify and develop treatment options for the disease.

http://www.mhealthnews.com/news/watson-help-kids-battling-rare-diseases

- More Partners Sign On to IBM Cloud

Meanwhile, IBM said HCL would use its Bluemix to develop IoT sensors deployed to collect and exchange data from networks of sensors. HCL is developing IoT networks as an adjunct to its flagship IT services and “enterprise digitalization” businesses.

http://www.enterprisetech.com/2015/11/12/more-partners-sign-on-to-ibm-cloud/

- IBM, Apple, and Watson: You are about to become obsolete

I like this post due to the insights of a former employee versus his thoughts about their current state.As this first set of sessions ended we had the guy running Watson speak on the fact that—for many professions—the professionals don’t know what they need to know. For instance, even attorneys that specialize don’t know the majority of the laws that define their specialty, let alone all of them. At the core of the IBM Watson effort and its general analytics push is to fix that problem. The time is coming when any professional that doesn’t have access to, and know how to use a tool like Watson will have inadequate skills to gain employment in the developed world.

http://techspective.net/2015/11/13/ibm-apple-and-watson-you-are-about-to-become-obsolete/

- Switch to Macs from PCs reportedly saves IBM US$270 per user

While 40 percent of IBM’s PC users call the helpdesk for troubleshooting, on average only 5 percent of the company’s Mac user do the same, according to Previn. “The longer this program runs, the more compelling the business case becomes,” he says. “I can confidently say that every Mac that we buy is making and saving IBM money.”

EMC

- Dell targets simpler cloud experience with EMC

Kelly points out that many of Dell’s and EMC’s businesses are complementary. For example, EMC storage and Dell servers aid the adoption of converged infrastructure and hybrid cloud; EMC’s RSA controls for identity assurance, fraud detection and data protection; security analytics; and GRC capabilities with Dell’s SecureWorks network security and managed security services; AirWatch mobile device, application and content management with KACE systems and device management; and the Pivotal open cloud platform and agile software development tools with the Boomi platform as a service.

http://www.networksasia.net/article/dell-targets-simpler-cloud-experience-emc.1447295769

- Dell’s EMC Acquisition In Danger Over Tax Problems – ($9B Tax Bill)

The use of this ‘tracking stock’ is intended to offset the amount of debt Dell would have to take on, and also help it avoid avoid a heavy tax bill. But it depends on the American IRS interprets the use of this tracking stock. According to the report, tracking stocks were commonly used during the dot.com boom years in the 1990s, and its use in the deal could invite scrutiny by the Internal Revenue Service.

“Dell’s plan to create tracking shares in a company it does not yet own (that’s VMware) would, if successful, amount to a clever threading of a needle in US tax laws,” said Re/code. “It is intended as neither a distribution of shares nor the spinoff of a subsidiary, both of which are typically taxable events. Instead, EMC shareholders will face taxes in the range of 20 percent to 40 percent for the gains on the cash and the value of the tracking shares.”

http://www.techweekeurope.co.uk/e-enterprise/merger-acquisition/dell-emc-tax-problems-180378

Read More:

http://www.reuters.com/article/2015/11/10/emc-us-ma-dell-idUSL3N1354VS20151110

Oracle

- Oracle’s Cloud Prospects Look Positive

Oracle has embarked on an aggressive strategy to win market share in the cloud market. However, the company is a late entrant and questions have surfaced on whether Oracle could succeed against early entrants such as Microsoft and market leader Amazon who established themselves in the cloud market years earlier than Oracle.

Credit: Wall Street Journal

http://seekingalpha.com/article/3675736-oracles-cloud-prospects-look-positive - Oracle Is About to Eat Amazon’s Lunch

Now, Oracle is acting as much out of envy and perhaps even desperation as anything else. While AMZN stock has doubled in 2015 despite a rough market, ORCL stock is down over 11%. And longer term, Oracle stock is up just 40% or so in the last five years vs. over 290% for Amazon stock and 70% for the broader S&P 500 in the same period.

But with some $56 billion in cash and investments and a will to roll out an ambitious suite of cloud products, AMZN investors should be looking over their shoulder at Oracle as it ramps up in the next six months.

http://investorplace.com/2015/11/amzn-stock-amazon-web-services-oracle/

Other

- Why Meg Whitman’s ‘Hmm …’ emails make HP managers scramble

So she told the whole company they were to follow a new rule. If they saw an issue they were to “escalate in 24 hours and resolve it in 48 hours. If that problem is not solved in 48, everyone has the right to send me an email. I’m an expert forwarder. When I forward an email on, things get done,” she said.

http://www.businessinsider.com/employees-fear-meg-whitman-hmm-email-2015-11

- Red Hat enhances containers across open hybrid cloud

“The datacenter is heterogeneous, and the cloud is hybrid”, said Paul Cormier, president of products and technologies at Red Hat. SUSE Linux Enterprise Server has been there for close to two years, and many enterprise customers are finding the benefits of deploying workloads on Linux in the public cloud. These offerings help developers to build and integrate faster and adaptable applications with familiar, supported open source tools with significantly less “ramp-up” time and a unified experience across hybrid architectures.

http://observerleader.com/2015/11/red-hat-enhances-containers-across-open-hybrid-cloud/

- A Closer Look At Microsoft And Red Hat Partnership

Meanwhile, Red Hat has gone through interesting times. Canonical Ubuntu gave it a tough competition as the most preferred Linux distribution in the public cloud. Minimalistic, container-optimized operating systems such as CoreOS and RancherOS started to gain popularity. Red Hat’s ambitious plan to repeat the magic with OpenStack, the open source cloud management platform, didn’t translate due to the lack of enterprise adoption. OpenShift, Red Hat’s PaaS was going through a major revamp to embrace containers and Kubernetes. The virtualization market has been shrinking, and there was enough pressure from VMware in this market. Given that Red Hat doesn’t have its own public cloud, its success comes from making RHEL a ubiquitous OS for enterprise workloads across multiple clouds. These factors forced Red Hat to consider partnering with Microsoft.

- Teradata Cuts Ties With The Marketing Stack

Some speculate private equity investors will step in and divest key marketing assets, similar to the path eBay Enterprise took. Others suggest any number of enterprise companies could serve as potential acquirers.

“Aprimo [a campaign manager Teradata bought for $525 million in 2010] was a good acquisition for them and they’ve done a lot with the marketing piece,” said Ray Wang, principal analyst and founder of Constellation Research. “If you’re a company that wants to build out marketing apps on top of a database and analytics, it would make sense for that.”

http://adexchanger.com/digital-marketing-2/teradata-cuts-ties-with-the-marketing-stack/

Photo: The Pic Pac