IBM has added another feather in their video stream capabilities cap with with purchase of Ustream. Considering that they recently picked up Clearleap and we should start paying attention to what IBM is doing with video services.

Investors are paying attention to EMC due to concerns that Dell might not be able to muster up the $40-50B needed to make this acquisition a reality.

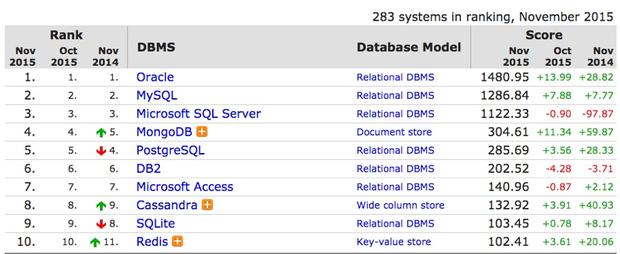

Oracle is in their own reality as they file a lawsuit against the State of Oregon for a failed healthcare portal implementation. They are also in the news for claiming cloud market leader Amazon is not “enterprise” enough for most businesses.

Keep an eye out for something between Splunk and IBM, there are rumors floating around…

IBM

- IBM buys Upstream to boost cloud-based video streaming services

IBM claimed that the division will allow the firm to target the cloud-based video streaming software and services market, which is estimated to be worth a hefty $105bn.

Robert LeBlanc, senior vice president at IBM Cloud, outlined Big Blue’s ambitions for the video streaming market, saying that video has become a “first-class data type in business that requires accelerated performance and powerful analytics that allows clients to extract meaningful insights”.

This comes after IBM announced the purchase of ClearLeap during the week of 12/12/2015. Clearleap that allows streaming video to scale.

More Information:

Coincidentally, IBM also announced the launch of its Cloud Video Services unit that includes previously acquired Clearleap, Cleversafe and Aspera along with 1,000 video related patents it has accumulated since 1995. The graphic at the top of this story explains the component parts for what IBM believes will be a $105 billion market opportunity by 2019.

IBM and video? You have to see this in a wider context. Video is a very fast growing part of enterprise content. It is also a resource hog that requires significant data management effort. However, it has been something off a Cinderella in the enterprise. This acquisition and launch change that perception. More compelling, video is a very good use case for Watson based analytics solutions.

https://diginomica.com/2016/01/21/ibm-acquires-ustream-expects-video-to-lose-its-cinderella-status/

- IBM profit forecast pulls stock to 5-year low

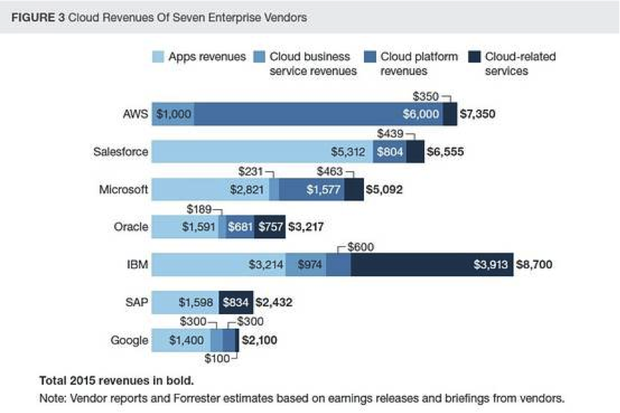

While sales of the new services, bundled together under the heading “strategic imperatives,” increased 16 percent to $28.9 billion in 2015, the company forecast profit this year far below analysts’ projections.

Operating earnings will be at least $13.50 a share in 2016, chief financial officer Martin Schroeter said Tuesday. That’s less than the $15 a share predicted by analysts. Currency fluctuations will affect operating earnings by more than $1 a share, he said.

- Execs: Strategic shift is paying off for IBM

That’s in spite of announcing for, the 15th consecutive quarter, falling revenue. IBM (NYSE: IBM), which was down nearly 5 percent during Wednesday morning trading, has been in a period of transition for the past few years, putting less focus on hardware and more focus (and investment dollars) into cloud, analytics, mobile, social media and security. Those strategic areas were up 26 percent for the year, making up a combined $29 billion and representing about 35 percent of the revenue. Cloud alone rose 43 percent to $10.2 billion for the year.

- IBM inks $40 million deal to transform the way people withdraw from ATMs

BTI Payments, which is a White Label ATM (WLA) operator, has entrusted IBM to transform its IT Infrastructure and deploy and manage an incremental 4,000 Automated Teller Machines (ATM) across the country.

This IT Infrastructure transformation will help reduce operational and capital expenditure while adding business value.

EMC | Dell

- Two big risks could torpedo Dell-EMC deal

Dell and its Silver Lake backers must now be worried that the deal will be dead in the water before it happens. They have to raise $40bn – $50bn in debt to finance the EMC acquisition. If that debt-raising exercise fails, because investment groups and organisations can’t see EMC shareholders accepting the tracking stock, and can’t also see why they should finance Dell/Silverlake buying EMC for 30 per cent more than it’s worth, then the whole deal could fall apart.

http://www.theregister.co.uk/2016/01/21/two_big_risk_torpedoes_could_screw_dellemc_deal/

HP Inc | Hewlett Packard Enterprise

- Trial date set for Hewlett-Packard multi-billion fraud case

Hewlett-Packard and Autonomy are to continue their long running $10 billion takeover dispute for a further two years, with a 2018 London trial set to see the two companies fight over $5.1 billion.

- Whitman: We’re doing OK, despite economic slowdown

http://www.cnbc.com/2016/01/21/whitman-were-doing-ok-despite-economic-slowdown.html

Oracle

- Oracle Jabs Again in Legal Fight with Oregon

Oracle responded with its own lawsuit last year that alleged certain Oregon officials purposely sabotaged the project for political reasons and shifted the blame to Oracle. The technology giant alleged in its new lawsuit that its company executives and staff members representing Oregon governor Kate Brown agreed to settle all of the lawsuits on Oct. 19.

http://fortune.com/2016/01/20/oracle-sues-oregon-healthcare-settlement/

- Amazon’s Cloud Is Not Enterprise-Ready, Says Oracle Exec

I love it when Oracle talks trash…“My conclusion is it’s easier to add cloud tech to an enterprise company than to add enterprise stuff to a cloud company,” he said. “I’m a legitimate convert because I thought this through before I joined up here.” Before joining Oracle in late 2014, Magnusson drove development of Google GOOG 2.62% App Engine.

http://fortune.com/2016/01/20/oracle-exec-says-aws-not-enterprise-ready/

Other

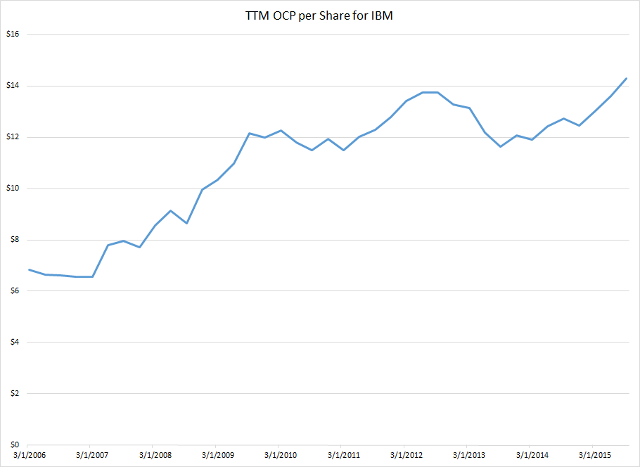

- Why IBM and Oracle Plunged in 2015 While Microsoft Soared 19% Higher

Ending on a positive note, we’re left with Redmond’s finest. Under Nadella, Microsoft has embraced many strategies that would have been unthinkable under Ballmer, and with good results. Despite a flagging PC market and a dead-end entry into the mobile market, Microsoft has found a way back to earnings growth and stabilizing revenues.

Like Oracle, the company is betting heavily on cloud computing. Unlike the database giant, Microsoft has found a big winner in its Windows Azure cloud-computing platform, which is an almost unchallenged No. 2 in that fast-growing market. Oracle is not even on the radar yet. So Microsoft is getting results from Nadella’s new strategy already, giving investors a strong return in 2015.

- Google’s new managed containers are brought to you by Red Hat

So Red Hat is in bed with Microsoft, and now Google… very interesting.Google and Red Hat are touting several advantages of their collaboration, including the fact that OpenShift could complement and expand the use of Kubernetes, Google’s container management and orchestration system. Kubernetes has fast become a standard-issue item on most cloud platforms with containers, and Red Hat is the No. 2 contributor to that project, behind Google.

- Splunk outperforms after analyst predicts major deal with IBM

Northland analyst Tim Klasell heard from a “few industry sources” that Splunk and IBM are “moving closer together” and could agree to a meaningful partnership over time. The analyst told investors in a research note that IBM is getting close to a “big move to improve its ties” with Splunk. While Klasell did not know the financial details, he believes such a partnership could be a “nice tailwind” for Splunk to sign larger deals. The analyst has an Outperform rating on Splunk with an $80 price target.