News You Can Use: 5/4/2016

- How a giant like GE found home in the cloud

Embracing a cloud-first mentality across the organization required adjustments internally, too. Drumgoole arrived at GE two years ago to find the traditional angst between software developers and infrastructure operators. Devs can’t get the infrastructure they need; ops folks don’t know what the software teams need. Cloud seemed like the natural answer to this problem.

GE invested in building tools, creating systems and processes for managing it and ensuring regulatory compliance. When GE’s IT team introduced the cloud services, some of those software developers and ops teams didn’t want to use it. “Some of the legacy, single-technology developers struggled with deploying and moving apps when we took away the support envelope of a traditional infrastructure team,” he says, adding that the challenge has largely been overcome, though it required a shift in mindset.

- No lawyer? This online tool uses AI to review your contracts

This seems like a major privacy concern, but intriguing none the less…Next, LawGeex uses its array of technologies to compare the contract against a database of thousands of similar ones. It flags anything that needs extra attention and also provides statistics and benchmarks.

Explained in simple terms, its final analysis — delivered within 24 hours, or on the next business day — aims to ensure that users know exactly what they’re agreeing to. Included in that report are a summary, a contract score, and information such as clause explanations, negotiating tips, and sample language for missing clauses.

http://www.cio.com/article/3058698/no-lawyer-this-online-tool-uses-ai-to-review-your-contracts.html

- How To Take Back Control Of A Negotiation

1. Establish that you’re there because they need you. If you’re a finalist, they must already have a very positive perception of what you can do for them.

2. Look for small ways to gain leverage. Moving the meeting to be last in the day is one example. Being last helps because the client learns from earlier presenters—and often shares that with you directly, like revealing that others had accepted an offer of $25,000.

3. Radiate confidence when you’re in the room. You must believe deeply in yourself; otherwise it’ll show. Remember, they can only get what you do from you.

4. Use your vulnerability. I knew that I’d feel anxious as soon as I first accepted the challenge of going after this project. The way to deal with those fears is by talking with your team and deciding what to do about them collectively. When I discovered who we were up against, that fear helped me realize how their size might actually be a weakness—which turned my own sense of vulnerability on its head. If nothing else, it encouraged the competition to underestimate us.

http://www.fastcompany.com/3058768/how-to-take-back-control-of-a-negotiation

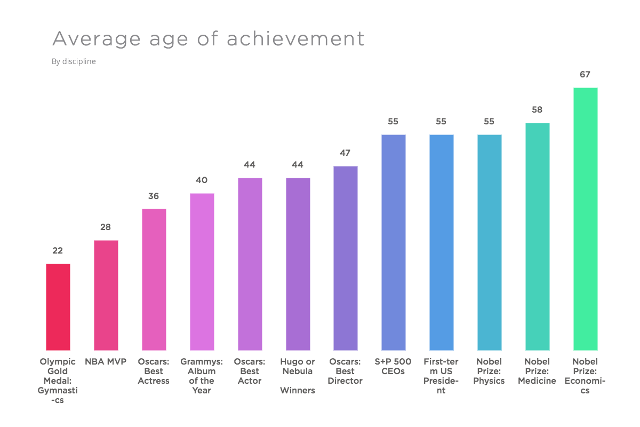

- These Are The Ages When We Do Our Best Work

Some, like professional athletes and CEOS, tend to cluster especially tightly around certain age ranges (because of constraints like physical prowess and work experience, respectively). However, in each of these fields, people tend to do great work at all sorts of ages. Though Adele pulled the Grammy Album of the Year down from an average of around 40 by winning at age 23, Ray Charles yanked it up by winning his Grammy at 74.

- Intel axes 12,000 jobs as it looks to break away from PCs

Intel is cutting 12,000 jobs worldwide as the company restructures operations to diversify from PCs into growth areas of IoT and servers.

The layoffs account for about 11 percent of employees worldwide. Intel is also consolidating work locations worldwide in a move the company hopes will save it US $750 million this year.

http://www.cio.com/article/3058610/intel-axes-12000-jobs-as-it-looks-to-break-away-from-pcs.html

- Verizon is offshoring jobs, records say

For instance, in Lake Mary, Florida, employees wrote on their TAA application: “Verizon has been in the process of moving all production for all products off shore for the last few years. We were notified in April [2015] that all the remaining VOIP Order Management was being moved to Manila. Two VOIP order managers had been sent to Manila to train the new group. … My group also had to train the offshore group to take over our job function. HR told me this was a massive layoff!”

Photo: Tom Sodoge

Supplier Report: 5/16/2015

IBM news continues to be dominated by Watson Health. Nothing new was announced this week, but analysts are catching up with the news and highlighting the trends.

Oracle and EMC continue their less-than-graceful transition to the cloud. Oracle is looking at lower cost (from their own hardware) Open Stack framework, while EMC also focuses on bringing a more flexible cloud solution to market.

And just because… Verizon buys AOL (for their content like Huffington Post and TechCrunch…probably).

IBM

- 6 tends to watch with IBM Watson Health:

The text message-based therapy startup Talkspace will use IBM’s Watson to analyze customers’ text messages and attempt to draw insights about their personality that will help match them to the best possible therapist on the platform.

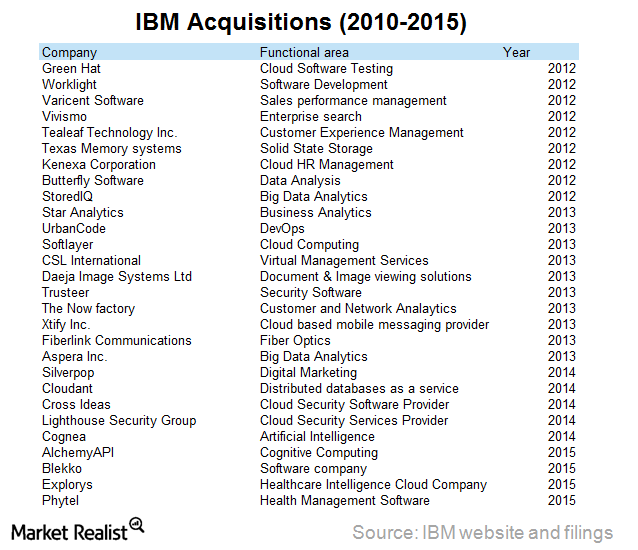

- With IBM’s recent acquisitions in the health analytics space, here is a list of the last 5 years of activity:

http://marketrealist.com/2015/05/ibm-aims-enhance-watson-health-phytel-acquisition/ - Does the IBM Emptoris and Coupa Announcement Raise More Partnership Questions Than Answers?

“…Together with IBM, we’re announcing a new joint solution that seamlessly combines IBM Strategic Supply Management with our Coupa Procure-to-Pay (P2P) and Coupa Open Business Network solutions. IBM and Coupa have partnered previously on joint ventures, and this new solution deepens our partnership.”

http://spendmatters.com/2015/05/14/ibm-emptoris-and-coupa-showcasing-multiple-elephants-in-the-partnership-room/

This procurement software talk is probably boring to the IT folks, but I saw this headline and had to share this article:

Ariba Doesn’t Have Customers, It Has Prisoners: [Bwahaha]Ariba is able to price its modules so aggressively because of supplier fees. Ariba mandates its hosted P2P tool users also use the Ariba network for all connectivity with suppliers, even in cases where suppliers are connected to other networks that then connect to Ariba’s in the same transaction stream (e.g., sending a PO via Ariba but invoicing via OB10).

http://spendmatters.com/2012/12/21/ariba-doesnt-have-customers-it-has-prisoners/

- This isn’t new news, but this is the first time I have seen Fitbit directly mentioned with Watson Health. It is a good article and it says what you probably think it should, but this is an interesting quote:

Secondly, healthcare data security has to be significantly enhanced, given the rampant incidents of data breaches that we have witnessed recently at large enterprises such as Anthem and Premera. Criminal attacks now target healthcare as one of the most lucrative sectors in the black market for personal data.

- IBM introduces new BlueMix Platform as a Service (PaaS) offerings:

IBM (IBM) announced the introduction of new services on Bluemix. Bluemix is a Cloud Foundry-based platform that enables developers to build, deploy, and manage apps across the cloud space. The new services will complement 100 services already available in the Bluemix portfolio. They’re expected to facilitate the development of cloud offerings for mobile, supply chain analytics, Internet of Things—or IoT, and intelligent infrastructure solutions.

- IBM responds to letter from U.S. Senator questioning use of H1-B visas

Jillian Fertig reported Monday that IBM was not meeting state requirements as far as employment numbers and that employees claim the company is laying off American workers and replacing them with foreign workers. Because those concerns have been raised in both Columbia and at the Dubuque, Iowa location, Fertig has been in regular contact with Senator Grassley’s office.

- IBM rainbow chip breakthrough uses pulses of light to transfer data at 100Gbps

Being able to send 100Gbps of data is equivalent to sending half of a HD movie from a Blu-ray disc per second, and IBM’s new chip would in theory make it possible for data to be transferred much faster and used for many commercial purposes, including making services like Google, Facebook, Spotify and Microsoft Office Online work much faster.

- IBM not expecting much growth in Brazil in 2015:

http://www.zdnet.com/article/ibm-predicts-timid-growth-in-brazil-for-2015/

Oracle

- Oracle Trying On OpenStack For Size

Still, even if Oracle can define $7 billion of its revenue as “cloud” this year, it would still represent less than 20% of last year’s $38.3 billion in revenue. Having its own true cloud, built on an open source infrastructure like OpenStack, would accelerate the move to true cloud economics. So might buying a profitable, growing OpenStack cloud provider like Rackspace(NYSE:RAX), but that’s purely speculation

http://seekingalpha.com/article/3183236-oracle-trying-on-openstack-for-size

- The incredible rags-to-riches story of Oracle founder Larry Ellison

“The very first version was Oracle Version 2,” he admitted at a customer conference last year. Their ploy worked. Oracle’s first customer was a big one: the CIA. It later became the most popular database ever sold. That success paid off for Ellison — according to the Wall Street Journal, he was the highest paid executive in the US before he stepped down as CEO in 2014.

http://www.businessinsider.com.au/rags-to-riches-story-of-larry-ellison-2015-5

- In Google Versus Oracle, Obama’s Administration is Torn

It’s a complicated and very technical issue, something that is not necessarily the forte of the Supreme Court. The fight over what is defensible as copyrighted work or not is far from resolved at any level, this is just the most high-profile manifestation of it. If the Supreme Court does take the case and rule on it one way or another, it could have a lot of long-term implications for how patents and trademarks on API code are treated. If Oracle wins, expect plenty more claims of ownership and a lot of litigation to come, at least in the short term. If Google wins, there will be less of that. That’s why Google’s argument includes the idea that without that code, the company wouldn’t have succeeded, meaning that innovation would be slowed if Oracle were to win.

http://dcinno.streetwise.co/2015/05/15/obama-torn-over-google-googl-vs-oracle-orcl-court-fight/

EMC

- Why ‘Project Horizon’ spells long-term gains for EMC

According to Clarke, Project Horizon is a “big departure” for EMC from the extensive ECM platform it has become associated with over the past few years. “With one of the largest portfolios of ECM capabilities, its platform has often been criticized as being too complex and expensive to implement,” Clarke claims. “By contrast, Project Horizon is built on Pivotal Cloud Foundry and will offer a choice of cloud deployments.

http://www.reseller.co.nz/article/575000/insight-why-project-horizon-spells-long-term-gains-emc/

- EMC “eating its young” to survive say analysts

Above all, Furrier suggested, “They need to take care of their current situation — they need to get out of the box business.” In the current competitive market, Furrier advocated that EMC “build an OS for the data center and enterprise,” despite the disruption this might cause. Furthermore, Furrier put forward the notion that “EMC has to become a utility platform with a business model that can compete in the current era.” The “game-changing moves” that EMC needs to make, said Furrier, should be “real-time, API-based” and include “unlimited compute.”

http://siliconangle.com/blog/2015/05/11/emc-eating-its-young-to-survive-say-analysts-emcworld/

- EMC: Rise of third platform could spell end for businesses unwilling to adapt

As alluded to by Goulden, the rise of the Information Generation and their preference for third-platform apps and services poses a major challenge for enterprises, which will need to adapt the way they work to the way this group of users likes to consume services.

Other

- What exactly is Verizon getting for $4.4B (AOL)?

By buying AOL, Verizon is getting much more than the 1990s dial-up Internet company that first introduced many Americans to the Web. Today AOL provides online video services, content and ads to 40,000 other publishers. It brings in $600 million in advertising. It has news sites such as The Huffington Post, TechCrunch and Engadget.

- Teradata Investor Issues Fourth Letter Urging Board to Sell

The memo, published on Wednesday, reiterated that the software and services company should be part of a bigger enterprise. Matrix cited Teradata’s May 7 earnings report, which showed that first-quarter sales of $582 million missed analysts’ average projection and gave a full-year adjusted profit forecast at the low end of estimates.

- SAS: What is Hadoop and why does it matter? [Merry Xmas Mr. Spoons]

http://www.sas.com/en_ca/insights/big-data/hadoop.html